Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

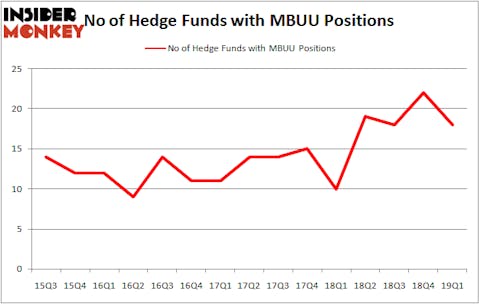

Is Malibu Boats Inc (NASDAQ:MBUU) a buy here? Investors who are in the know are in a bearish mood. The number of bullish hedge fund bets fell by 4 lately. Our calculations also showed that MBUU isn’t among the 30 most popular stocks among hedge funds. MBUU was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. There were 22 hedge funds in our database with MBUU holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the fresh hedge fund action encompassing Malibu Boats Inc (NASDAQ:MBUU).

What have hedge funds been doing with Malibu Boats Inc (NASDAQ:MBUU)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MBUU over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Malibu Boats Inc (NASDAQ:MBUU), with a stake worth $43.5 million reported as of the end of March. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $18.3 million. Driehaus Capital, Two Sigma Advisors, and Shellback Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Malibu Boats Inc (NASDAQ:MBUU) has witnessed bearish sentiment from hedge fund managers, logic holds that there exists a select few hedgies that elected to cut their entire stakes heading into Q3. Interestingly, Principal Global Investors’s Columbus Circle Investors cut the biggest investment of all the hedgies followed by Insider Monkey, comprising about $3.9 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund sold off about $1.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 4 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Malibu Boats Inc (NASDAQ:MBUU). We will take a look at Materialise NV (NASDAQ:MTLS), Yirendai Ltd. (NYSE:YRD), Ehi Car Services Ltd (NYSE:EHIC), and Urstadt Biddle Properties Inc (NYSE:UBA). This group of stocks’ market valuations are closest to MBUU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTLS | 4 | 9101 | 0 |

| YRD | 3 | 5126 | 0 |

| EHIC | 4 | 33238 | -2 |

| UBA | 8 | 29719 | 1 |

| Average | 4.75 | 19296 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $97 million in MBUU’s case. Urstadt Biddle Properties Inc (NYSE:UBA) is the most popular stock in this table. On the other hand Yirendai Ltd. (NYSE:YRD) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Malibu Boats Inc (NASDAQ:MBUU) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MBUU wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MBUU were disappointed as the stock returned -6.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.