During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Mack Cali Realty Corp (NYSE:CLI) and see how the stock is affected by the recent hedge fund activity.

Mack Cali Realty Corp (NYSE:CLI) shareholders have witnessed a decrease in activity from the world’s largest hedge funds recently. Our calculations also showed that CLI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of signals shareholders employ to analyze stocks. Some of the most innovative signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top hedge fund managers can outpace the S&P 500 by a very impressive amount (see the details here).

Let’s take a gander at the recent hedge fund action encompassing Mack Cali Realty Corp (NYSE:CLI).

What does the smart money think about Mack Cali Realty Corp (NYSE:CLI)?

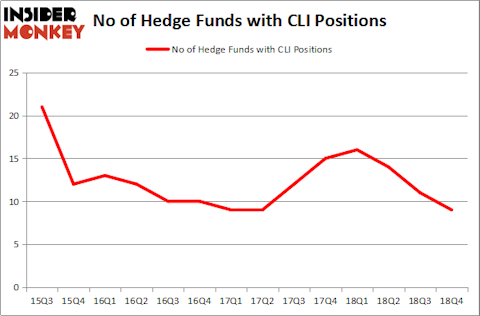

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from the second quarter of 2018. By comparison, 16 hedge funds held shares or bullish call options in CLI a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the biggest position in Mack Cali Realty Corp (NYSE:CLI). Renaissance Technologies has a $86.4 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Land & Buildings Investment Management, led by Jonathan Litt, holding a $11.7 million position; 3.3% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that are bullish include Eduardo Abush’s Waterfront Capital Partners, Ken Fisher’s Fisher Asset Management and Cliff Asness’s AQR Capital Management.

Since Mack Cali Realty Corp (NYSE:CLI) has faced a decline in interest from hedge fund managers, it’s easy to see that there were a few hedge funds who sold off their entire stakes in the third quarter. At the top of the heap, Israel Englander’s Millennium Management sold off the largest position of the “upper crust” of funds monitored by Insider Monkey, worth close to $2.3 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also said goodbye to its stock, about $0.8 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 2 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Mack Cali Realty Corp (NYSE:CLI) but similarly valued. These stocks are Opko Health Inc. (NASDAQ:OPK), Kosmos Energy Ltd (NYSE:KOS), Innoviva, Inc. (NASDAQ:INVA), and MSG Networks Inc (NYSE:MSGN). This group of stocks’ market values are similar to CLI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OPK | 15 | 5892 | 1 |

| KOS | 14 | 107311 | -4 |

| INVA | 22 | 311564 | 0 |

| MSGN | 20 | 264027 | -3 |

| Average | 17.75 | 172199 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $172 million. That figure was $115 million in CLI’s case. Innoviva, Inc. (NASDAQ:INVA) is the most popular stock in this table. On the other hand Kosmos Energy Ltd (NYSE:KOS) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Mack Cali Realty Corp (NYSE:CLI) is even less popular than KOS. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CLI, though not to the same extent, as the stock returned 16.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.