Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Luther Burbank Corporation (NASDAQ:LBC) to find out whether it was one of their high conviction long-term ideas.

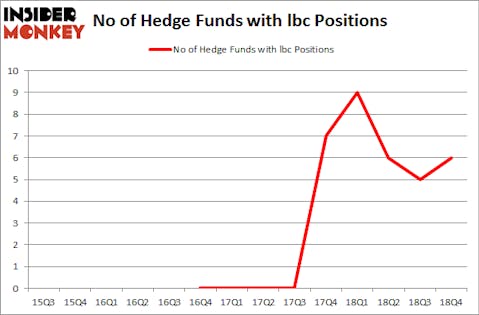

Luther Burbank Corporation (NASDAQ:LBC) was in 6 hedge funds’ portfolios at the end of the fourth quarter of 2018. LBC investors should be aware of an increase in activity from the world’s largest hedge funds lately. There were 5 hedge funds in our database with LBC positions at the end of the previous quarter. Our calculations also showed that lbc isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are plenty of indicators shareholders put to use to evaluate stocks. A couple of the most useful indicators are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can outperform their index-focused peers by a very impressive margin (see the details here).

We’re going to review the new hedge fund action regarding Luther Burbank Corporation (NASDAQ:LBC).

How are hedge funds trading Luther Burbank Corporation (NASDAQ:LBC)?

Heading into the first quarter of 2019, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the previous quarter. By comparison, 9 hedge funds held shares or bullish call options in LBC a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Matthew Lindenbaum’s Basswood Capital has the number one position in Luther Burbank Corporation (NASDAQ:LBC), worth close to $22.7 million, corresponding to 1.3% of its total 13F portfolio. The second most bullish fund manager is MFP Investors, led by Michael Price, holding a $2.8 million position; 0.4% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish include Joshua Nash’s Ulysses Management, Anton Schutz’s Mendon Capital Advisors and Ken Griffin’s Citadel Investment Group.

As industrywide interest jumped, some big names have been driving this bullishness. Mendon Capital Advisors, managed by Anton Schutz, assembled the most valuable position in Luther Burbank Corporation (NASDAQ:LBC). Mendon Capital Advisors had $0.8 million invested in the company at the end of the quarter.

Let’s check out hedge fund activity in other stocks similar to Luther Burbank Corporation (NASDAQ:LBC). We will take a look at Foresight Energy LP (NYSE:FELP), SI-BONE, Inc. (NASDAQ:SIBN), The First of Long Island Corporation (NASDAQ:FLIC), and China Yuchai International Limited (NYSE:CYD). This group of stocks’ market valuations are similar to LBC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FELP | 3 | 771 | 0 |

| SIBN | 9 | 69929 | 9 |

| FLIC | 9 | 40733 | -3 |

| CYD | 8 | 54989 | 0 |

| Average | 7.25 | 41606 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $27 million in LBC’s case. SI-BONE, Inc. (NASDAQ:SIBN) is the most popular stock in this table. On the other hand Foresight Energy LP (NYSE:FELP) is the least popular one with only 3 bullish hedge fund positions. Luther Burbank Corporation (NASDAQ:LBC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on LBC, though not to the same extent, as the stock returned 17.2% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.