At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

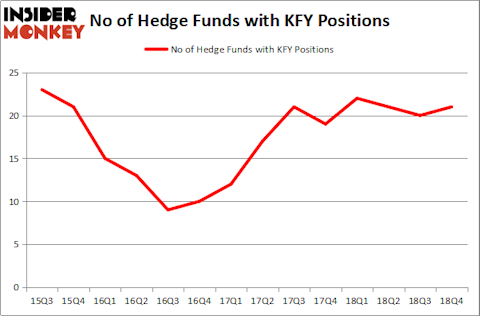

Korn/Ferry International (NYSE:KFY) shareholders have witnessed an increase in enthusiasm from smart money in recent months. Our calculations also showed that KFY isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are seen as unimportant, old financial tools of years past. While there are more than 8000 funds trading at the moment, We look at the masters of this club, approximately 750 funds. These hedge fund managers watch over the lion’s share of the smart money’s total capital, and by following their finest equity investments, Insider Monkey has spotted many investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a glance at the latest hedge fund action encompassing Korn/Ferry International (NYSE:KFY).

How are hedge funds trading Korn/Ferry International (NYSE:KFY)?

At Q4’s end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the second quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in KFY a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GLG Partners held the most valuable stake in Korn/Ferry International (NYSE:KFY), which was worth $31.5 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $15.1 million worth of shares. Moreover, Renaissance Technologies, Citadel Investment Group, and AQR Capital Management were also bullish on Korn/Ferry International (NYSE:KFY), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers have jumped into Korn/Ferry International (NYSE:KFY) headfirst. Algert Coldiron Investors, managed by Peter Algert and Kevin Coldiron, assembled the most outsized position in Korn/Ferry International (NYSE:KFY). Algert Coldiron Investors had $1.8 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also made a $0.7 million investment in the stock during the quarter. The following funds were also among the new KFY investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Hoon Kim’s Quantinno Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Korn/Ferry International (NYSE:KFY) but similarly valued. These stocks are Eldorado Gold Corp (NYSE:EGO), Yamana Gold Inc. (NYSE:AUY), NuStar Energy L.P. (NYSE:NS), and Penn National Gaming, Inc (NASDAQ:PENN). All of these stocks’ market caps are closest to KFY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGO | 8 | 4288 | -1 |

| AUY | 19 | 78472 | 1 |

| NS | 2 | 4998 | 0 |

| PENN | 18 | 103334 | -6 |

| Average | 11.75 | 47773 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $78 million in KFY’s case. Yamana Gold Inc. (NYSE:AUY) is the most popular stock in this table. On the other hand NuStar Energy L.P. (NYSE:NS) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Korn/Ferry International (NYSE:KFY) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on KFY, though not to the same extent, as the stock returned 18.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.