Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN) was in 4 hedge funds’ portfolios at the end of the fourth quarter of 2018. KYN investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. There were 3 hedge funds in our database with KYN positions at the end of the previous quarter. Our calculations also showed that KYN isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action regarding Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN).

What does the smart money think about Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN)?

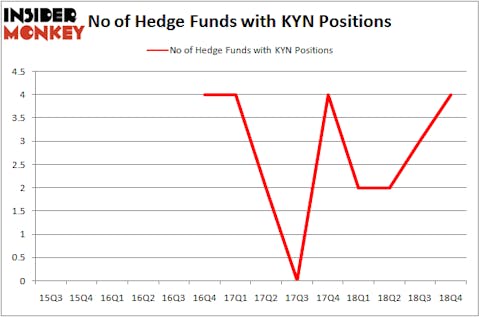

Heading into the first quarter of 2019, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in KYN over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN) was held by Horizon Asset Management, which reported holding $4.4 million worth of stock at the end of December. It was followed by Millennium Management with a $0.7 million position. Other investors bullish on the company included Coe Capital Management, Weiss Asset Management, and Citadel Investment Group.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Weiss Asset Management, managed by Andrew Weiss, created the most valuable position in Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN). Weiss Asset Management had $0.2 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.2 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN). These stocks are TowneBank (NASDAQ:TOWN), PTC Therapeutics, Inc. (NASDAQ:PTCT), Steelcase Inc. (NYSE:SCS), and Apptio, Inc. (NASDAQ:APTI). This group of stocks’ market values resemble KYN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TOWN | 8 | 31981 | -1 |

| PTCT | 25 | 434907 | -5 |

| SCS | 22 | 83481 | 3 |

| APTI | 22 | 387162 | -3 |

| Average | 19.25 | 234383 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $234 million. That figure was $6 million in KYN’s case. PTC Therapeutics, Inc. (NASDAQ:PTCT) is the most popular stock in this table. On the other hand TowneBank (NASDAQ:TOWN) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Kayne Anderson MLP/Midstream Investment Company (NYSE:KYN) is even less popular than TOWN. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on KYN, though not to the same extent, as the stock returned 19.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.