Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Heritage Commerce Corp. (NASDAQ:HTBK).

Heritage Commerce Corp. (NASDAQ:HTBK) has experienced a decrease in hedge fund interest recently. Our calculations also showed that htbk isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the key hedge fund action encompassing Heritage Commerce Corp. (NASDAQ:HTBK).

Hedge fund activity in Heritage Commerce Corp. (NASDAQ:HTBK)

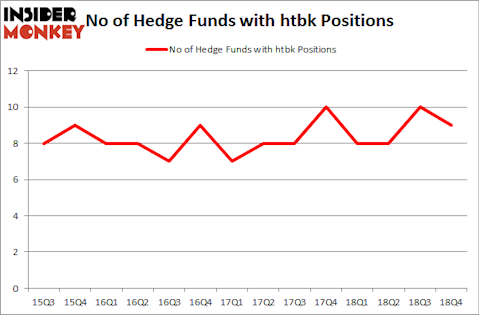

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards HTBK over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in Heritage Commerce Corp. (NASDAQ:HTBK). Renaissance Technologies has a $11.4 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is D. E. Shaw of D E Shaw, with a $2.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism comprise John Overdeck and David Siegel’s Two Sigma Advisors, Israel Englander’s Millennium Management and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Due to the fact that Heritage Commerce Corp. (NASDAQ:HTBK) has witnessed declining sentiment from the entirety of the hedge funds we track, logic holds that there is a sect of funds who sold off their entire stakes by the end of the third quarter. Intriguingly, Cliff Asness’s AQR Capital Management dropped the largest investment of the “upper crust” of funds tracked by Insider Monkey, comprising close to $1.6 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund dropped about $0.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Heritage Commerce Corp. (NASDAQ:HTBK) but similarly valued. We will take a look at International Seaways, Inc. (NYSE:INSW), Gamco Investors Inc. (NYSE:GBL), 111, Inc. (NASDAQ:YI), and Tower International Inc (NYSE:TOWR). This group of stocks’ market valuations resemble HTBK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INSW | 8 | 188804 | 0 |

| GBL | 8 | 8721 | -1 |

| YI | 3 | 12908 | 0 |

| TOWR | 16 | 41607 | 3 |

| Average | 8.75 | 63010 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $22 million in HTBK’s case. Tower International Inc (NYSE:TOWR) is the most popular stock in this table. On the other hand 111, Inc. (NASDAQ:YI) is the least popular one with only 3 bullish hedge fund positions. Heritage Commerce Corp. (NASDAQ:HTBK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HTBK wasn’t nearly as popular as these 15 stock and hedge funds that were betting on HTBK were disappointed as the stock returned 9.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.