Is Harsco Corporation (NYSE:HSC) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

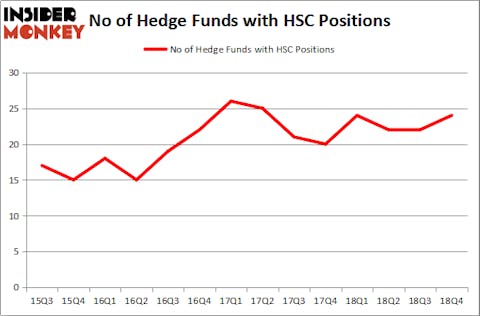

Harsco Corporation (NYSE:HSC) investors should be aware of an increase in enthusiasm from smart money recently. Our calculations also showed that HSC isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are seen as slow, old investment vehicles of years past. While there are greater than 8000 funds with their doors open at present, We look at the masters of this club, about 750 funds. It is estimated that this group of investors preside over bulk of the smart money’s total capital, and by watching their best equity investments, Insider Monkey has unearthed a few investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the key hedge fund action surrounding Harsco Corporation (NYSE:HSC).

How are hedge funds trading Harsco Corporation (NYSE:HSC)?

Heading into the first quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the previous quarter. On the other hand, there were a total of 24 hedge funds with a bullish position in HSC a year ago. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in Harsco Corporation (NYSE:HSC) was held by SG Capital Management, which reported holding $30.6 million worth of stock at the end of December. It was followed by Adage Capital Management with a $21.9 million position. Other investors bullish on the company included Winton Capital Management, Columbus Circle Investors, and Millennium Management.

Now, specific money managers have jumped into Harsco Corporation (NYSE:HSC) headfirst. Winton Capital Management, managed by David Harding, initiated the biggest position in Harsco Corporation (NYSE:HSC). Winton Capital Management had $8.5 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also made a $0.6 million investment in the stock during the quarter. The following funds were also among the new HSC investors: Matthew Tewksbury’s Stevens Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Harsco Corporation (NYSE:HSC) but similarly valued. We will take a look at Plexus Corp. (NASDAQ:PLXS), Progress Software Corporation (NASDAQ:PRGS), Pacific Premier Bancorp, Inc. (NASDAQ:PPBI), and Grupo Simec S.A.B. de C.V. (NYSEAMEX:SIM). This group of stocks’ market caps are similar to HSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLXS | 14 | 71897 | 2 |

| PRGS | 22 | 242639 | -2 |

| PPBI | 9 | 69154 | 0 |

| SIM | 1 | 2346 | 0 |

| Average | 11.5 | 96509 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $97 million. That figure was $113 million in HSC’s case. Progress Software Corporation (NASDAQ:PRGS) is the most popular stock in this table. On the other hand Grupo Simec S.A.B. de C.V. (NYSEAMEX:SIM) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Harsco Corporation (NYSE:HSC) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HSC wasn’t nearly as popular as these 15 stock and hedge funds that were betting on HSC were disappointed as the stock returned 12.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.