Is Four Corners Property Trust, Inc. (NYSE:FCPT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

Hedge fund interest in Four Corners Property Trust, Inc. (NYSE:FCPT) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as GCP Applied Technologies Inc. (NYSE:GCP), Renasant Corporation (NASDAQ:RNST), and Columbia Financial, Inc. (NASDAQ:CLBK) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action surrounding Four Corners Property Trust, Inc. (NYSE:FCPT).

How have hedgies been trading Four Corners Property Trust, Inc. (NYSE:FCPT)?

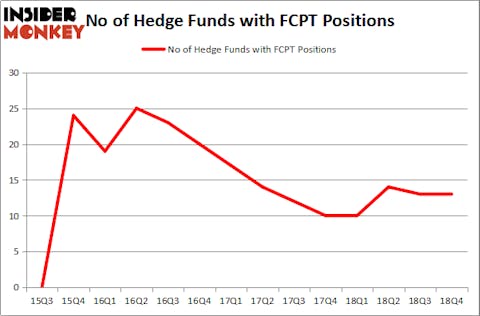

At Q4’s end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in FCPT a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Four Corners Property Trust, Inc. (NYSE:FCPT) was held by Balyasny Asset Management, which reported holding $21.2 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $18.5 million position. Other investors bullish on the company included Carlson Capital, Millennium Management, and Waterfront Capital Partners.

Due to the fact that Four Corners Property Trust, Inc. (NYSE:FCPT) has experienced declining sentiment from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of hedgies that slashed their full holdings heading into Q3. At the top of the heap, Jeffrey Pierce’s Snow Park Capital Partners sold off the biggest stake of the “upper crust” of funds followed by Insider Monkey, comprising an estimated $5.1 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also sold off its stock, about $0.6 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Four Corners Property Trust, Inc. (NYSE:FCPT) but similarly valued. These stocks are GCP Applied Technologies Inc. (NYSE:GCP), Renasant Corporation (NASDAQ:RNST), Columbia Financial, Inc. (NASDAQ:CLBK), and Pacira Pharmaceuticals Inc (NASDAQ:PCRX). This group of stocks’ market values are closest to FCPT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GCP | 16 | 435331 | -3 |

| RNST | 13 | 34274 | -4 |

| CLBK | 6 | 25171 | -1 |

| PCRX | 25 | 540796 | 0 |

| Average | 15 | 258893 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $259 million. That figure was $97 million in FCPT’s case. Pacira Pharmaceuticals Inc (NASDAQ:PCRX) is the most popular stock in this table. On the other hand Columbia Financial, Inc. (NASDAQ:CLBK) is the least popular one with only 6 bullish hedge fund positions. Four Corners Property Trust, Inc. (NYSE:FCPT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FCPT wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); FCPT investors were disappointed as the stock returned 8.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.