Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Flexion Therapeutics Inc (NASDAQ:FLXN).

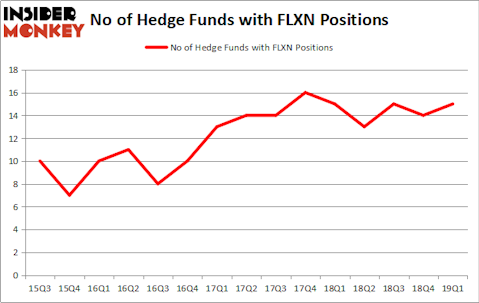

Is Flexion Therapeutics Inc (NASDAQ:FLXN) the right investment to pursue these days? Prominent investors are getting more bullish. The number of bullish hedge fund positions went up by 1 lately. Our calculations also showed that FLXN isn’t among the 30 most popular stocks among hedge funds. FLXN was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with FLXN positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action encompassing Flexion Therapeutics Inc (NASDAQ:FLXN).

Hedge fund activity in Flexion Therapeutics Inc (NASDAQ:FLXN)

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in FLXN a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Kingdon Capital held the most valuable stake in Flexion Therapeutics Inc (NASDAQ:FLXN), which was worth $11 million at the end of the first quarter. On the second spot was Rubric Capital Management which amassed $9 million worth of shares. Moreover, Clearline Capital, D E Shaw, and Carlson Capital were also bullish on Flexion Therapeutics Inc (NASDAQ:FLXN), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have been driving this bullishness. Oaktree Capital Management, managed by Howard Marks, established the most valuable position in Flexion Therapeutics Inc (NASDAQ:FLXN). Oaktree Capital Management had $4.4 million invested in the company at the end of the quarter. Bernard Selz’s Selz Capital also initiated a $3.6 million position during the quarter. The other funds with brand new FLXN positions are Peter Muller’s PDT Partners, Jeffrey Talpins’s Element Capital Management, and Sander Gerber’s Hudson Bay Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Flexion Therapeutics Inc (NASDAQ:FLXN) but similarly valued. These stocks are FRP Holdings Inc (NASDAQ:FRPH), Energy Recovery, Inc. (NASDAQ:ERII), The Hackett Group, Inc. (NASDAQ:HCKT), and J.C. Penney Company, Inc. (NYSE:JCP). This group of stocks’ market valuations are similar to FLXN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRPH | 8 | 43576 | 1 |

| ERII | 9 | 39697 | 2 |

| HCKT | 10 | 60507 | 0 |

| JCP | 13 | 45079 | -4 |

| Average | 10 | 47215 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $48 million in FLXN’s case. J.C. Penney Company, Inc. (NYSE:JCP) is the most popular stock in this table. On the other hand FRP Holdings Inc (NASDAQ:FRPH) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Flexion Therapeutics Inc (NASDAQ:FLXN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FLXN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FLXN were disappointed as the stock returned -5.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.