The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded First Midwest Bancorp Inc (NASDAQ:FMBI) based on those filings.

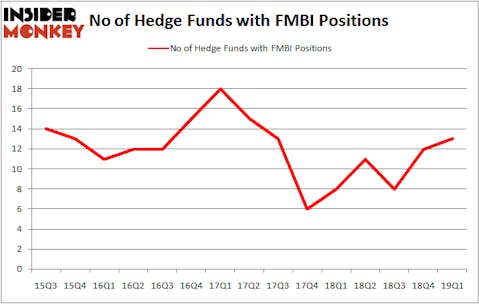

Is First Midwest Bancorp Inc (NASDAQ:FMBI) an exceptional investment now? Money managers are getting more bullish. The number of long hedge fund bets moved up by 1 recently. Our calculations also showed that FMBI isn’t among the 30 most popular stocks among hedge funds.

Today there are numerous indicators stock traders can use to grade publicly traded companies. A couple of the most innovative indicators are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outclass their index-focused peers by a healthy margin (see the details here).

We’re going to take a look at the new hedge fund action regarding First Midwest Bancorp Inc (NASDAQ:FMBI).

What does smart money think about First Midwest Bancorp Inc (NASDAQ:FMBI)?

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in FMBI a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, Pzena Investment Management held the most valuable stake in First Midwest Bancorp Inc (NASDAQ:FMBI), which was worth $30.6 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $6.2 million worth of shares. Moreover, D E Shaw, Millennium Management, and Balyasny Asset Management were also bullish on First Midwest Bancorp Inc (NASDAQ:FMBI), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have been driving this bullishness. GLG Partners, managed by Noam Gottesman, created the most outsized position in First Midwest Bancorp Inc (NASDAQ:FMBI). GLG Partners had $0.9 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $0.3 million position during the quarter. The following funds were also among the new FMBI investors: John Overdeck and David Siegel’s Two Sigma Advisors, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Roger Ibbotson’s Zebra Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as First Midwest Bancorp Inc (NASDAQ:FMBI) but similarly valued. These stocks are NetScout Systems, Inc. (NASDAQ:NTCT), RH (NYSE:RH), Trustmark Corp (NASDAQ:TRMK), and Aerie Pharmaceuticals Inc (NASDAQ:AERI). All of these stocks’ market caps are similar to FMBI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTCT | 12 | 97736 | -2 |

| RH | 36 | 260836 | 8 |

| TRMK | 11 | 37111 | 1 |

| AERI | 23 | 532150 | 0 |

| Average | 20.5 | 231958 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $232 million. That figure was $50 million in FMBI’s case. RH (NYSE:RH) is the most popular stock in this table. On the other hand Trustmark Corp (NASDAQ:TRMK) is the least popular one with only 11 bullish hedge fund positions. First Midwest Bancorp Inc (NASDAQ:FMBI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FMBI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); FMBI investors were disappointed as the stock returned 1.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.