A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of First Citizens BancShares Inc. (NASDAQ:FCNCA) during the quarter.

Is First Citizens BancShares Inc. (NASDAQ:FCNCA) a buy, sell, or hold? Investors who are in the know are in an optimistic mood. The number of bullish hedge fund positions rose by 3 lately. Our calculations also showed that FCNCA isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the fresh hedge fund action encompassing First Citizens BancShares Inc. (NASDAQ:FCNCA).

Hedge fund activity in First Citizens BancShares Inc. (NASDAQ:FCNCA)

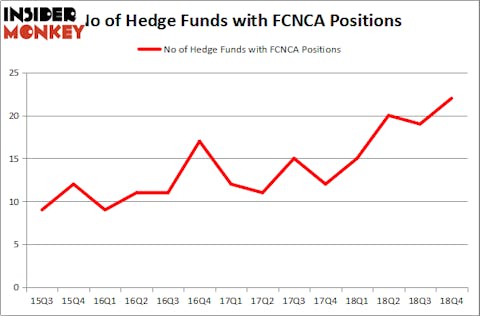

At Q4’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 16% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FCNCA over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in First Citizens BancShares Inc. (NASDAQ:FCNCA), which was worth $61.8 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $55.1 million worth of shares. Moreover, Huber Capital Management, Basswood Capital, and AQR Capital Management were also bullish on First Citizens BancShares Inc. (NASDAQ:FCNCA), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Citadel Investment Group, managed by Ken Griffin, initiated the largest position in First Citizens BancShares Inc. (NASDAQ:FCNCA). Citadel Investment Group had $0.7 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $0.5 million position during the quarter. The following funds were also among the new FCNCA investors: Minhua Zhang’s Weld Capital Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as First Citizens BancShares Inc. (NASDAQ:FCNCA) but similarly valued. These stocks are First Solar, Inc. (NASDAQ:FSLR), GCI Liberty, Inc. (NASDAQ:GLIBA), Ashland Global Holdings Inc.. (NYSE:ASH), and Universal Display Corporation (NASDAQ:OLED). This group of stocks’ market valuations match FCNCA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSLR | 22 | 352890 | 8 |

| GLIBA | 37 | 1382128 | 1 |

| ASH | 37 | 1143105 | 5 |

| OLED | 10 | 80618 | -10 |

| Average | 26.5 | 739685 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $740 million. That figure was $205 million in FCNCA’s case. GCI Liberty, Inc. (NASDAQ:GLIBA) is the most popular stock in this table. On the other hand Universal Display Corporation (NASDAQ:OLED) is the least popular one with only 10 bullish hedge fund positions. First Citizens BancShares Inc. (NASDAQ:FCNCA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FCNCA wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); FCNCA investors were disappointed as the stock returned 15% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.