Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

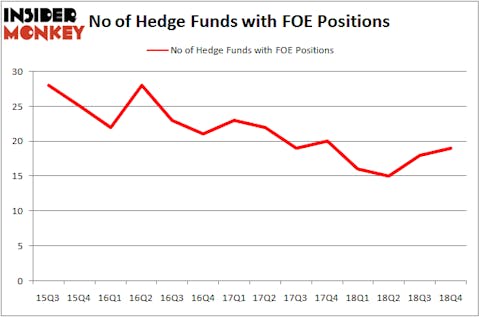

Is Ferro Corporation (NYSE:FOE) an exceptional stock to buy now? The smart money is becoming more confident. The number of long hedge fund bets went up by 1 in recent months. Our calculations also showed that FOE isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a glance at the recent hedge fund action surrounding Ferro Corporation (NYSE:FOE).

How have hedgies been trading Ferro Corporation (NYSE:FOE)?

Heading into the first quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in FOE a year ago. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in Ferro Corporation (NYSE:FOE) was held by GAMCO Investors, which reported holding $67.1 million worth of stock at the end of December. It was followed by Luminus Management with a $58.7 million position. Other investors bullish on the company included Scopus Asset Management, Brigade Capital, and Royce & Associates.

As one would reasonably expect, some big names have been driving this bullishness. Citadel Investment Group, managed by Ken Griffin, initiated the most valuable position in Ferro Corporation (NYSE:FOE). Citadel Investment Group had $0.9 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $0.9 million position during the quarter. The following funds were also among the new FOE investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Minhua Zhang’s Weld Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks similar to Ferro Corporation (NYSE:FOE). These stocks are Hawaiian Holdings, Inc. (NASDAQ:HA), Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC), Matthews International Corp (NASDAQ:MATW), and Raven Industries, Inc. (NASDAQ:RAVN). This group of stocks’ market caps match FOE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HA | 14 | 86673 | 0 |

| TRHC | 12 | 24139 | 2 |

| MATW | 12 | 53497 | 0 |

| RAVN | 15 | 75979 | 0 |

| Average | 13.25 | 60072 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $211 million in FOE’s case. Raven Industries, Inc. (NASDAQ:RAVN) is the most popular stock in this table. On the other hand Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Ferro Corporation (NYSE:FOE) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FOE wasn’t nearly as popular as these 15 stock and hedge funds that were betting on FOE were disappointed as the stock returned 14.9% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.