Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about F5 Networks, Inc. (NASDAQ:FFIV).

F5 Networks, Inc. (NASDAQ:FFIV) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 24 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Huaneng Power International Inc (NYSE:HNP), Tiffany & Co. (NYSE:TIF), and Tapestry, Inc. (NYSE:TPR) to gather more data points.

Today there are tons of signals stock market investors have at their disposal to analyze publicly traded companies. Some of the most innovative signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can outperform the S&P 500 by a solid margin (see the details here).

Let’s check out the fresh hedge fund action encompassing F5 Networks, Inc. (NASDAQ:FFIV).

What have hedge funds been doing with F5 Networks, Inc. (NASDAQ:FFIV)?

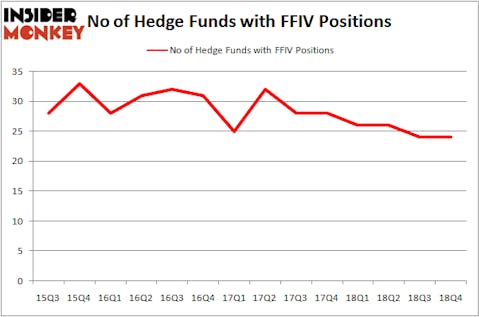

Heading into the first quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in FFIV over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in F5 Networks, Inc. (NASDAQ:FFIV), which was worth $400.9 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $317.6 million worth of shares. Moreover, D E Shaw, Arrowstreet Capital, and GLG Partners were also bullish on F5 Networks, Inc. (NASDAQ:FFIV), allocating a large percentage of their portfolios to this stock.

Since F5 Networks, Inc. (NASDAQ:FFIV) has witnessed falling interest from the smart money, we can see that there lies a certain “tier” of fund managers that elected to cut their positions entirely by the end of the third quarter. It’s worth mentioning that Malcolm Fairbairn’s Ascend Capital said goodbye to the biggest position of all the hedgies tracked by Insider Monkey, comprising close to $14 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund said goodbye to about $9.3 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as F5 Networks, Inc. (NASDAQ:FFIV) but similarly valued. These stocks are Huaneng Power International Inc (NYSE:HNP), Tiffany & Co. (NYSE:TIF), Tapestry, Inc. (NYSE:TPR), and Jack Henry & Associates, Inc. (NASDAQ:JKHY). This group of stocks’ market caps match FFIV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HNP | 3 | 1184 | -1 |

| TIF | 30 | 1225531 | -13 |

| TPR | 38 | 579451 | 5 |

| JKHY | 21 | 197585 | 7 |

| Average | 23 | 500938 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $501 million. That figure was $1091 million in FFIV’s case. Tapestry, Inc. (NYSE:TPR) is the most popular stock in this table. On the other hand Huaneng Power International Inc (NYSE:HNP) is the least popular one with only 3 bullish hedge fund positions. F5 Networks, Inc. (NASDAQ:FFIV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately FFIV wasn’t in this group. Hedge funds that bet on FFIV were disappointed as the stock lost 5.1% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.