How do we determine whether Essential Properties Realty Trust, Inc. (NYSE:EPRT) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

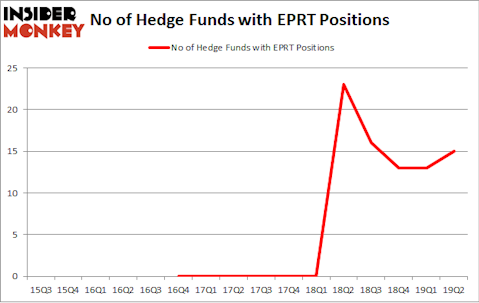

Is Essential Properties Realty Trust, Inc. (NYSE:EPRT) a buy here? Money managers are becoming hopeful. The number of bullish hedge fund positions rose by 2 lately. Our calculations also showed that EPRT isn’t among the 30 most popular stocks among hedge funds (see the video below). EPRT was in 15 hedge funds’ portfolios at the end of the second quarter of 2019. There were 13 hedge funds in our database with EPRT positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are many signals stock market investors can use to appraise publicly traded companies. Two of the less utilized signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outpace the S&P 500 by a very impressive margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the recent hedge fund action encompassing Essential Properties Realty Trust, Inc. (NYSE:EPRT).

What have hedge funds been doing with Essential Properties Realty Trust, Inc. (NYSE:EPRT)?

At the end of the second quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from the first quarter of 2019. By comparison, 23 hedge funds held shares or bullish call options in EPRT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Israel Englander’s Millennium Management has the most valuable position in Essential Properties Realty Trust, Inc. (NYSE:EPRT), worth close to $40.9 million, accounting for 0.1% of its total 13F portfolio. The second most bullish fund manager is Citadel Investment Group, managed by Ken Griffin, which holds a $20.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism contain Clint Carlson’s Carlson Capital, D. E. Shaw’s D E Shaw and John Overdeck and David Siegel’s Two Sigma Advisors.

As aggregate interest increased, some big names were breaking ground themselves. Renaissance Technologies, established the biggest position in Essential Properties Realty Trust, Inc. (NYSE:EPRT). Renaissance Technologies had $5.7 million invested in the company at the end of the quarter. Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors also initiated a $0.8 million position during the quarter. The following funds were also among the new EPRT investors: Minhua Zhang’s Weld Capital Management, Matthew Tewksbury’s Stevens Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Essential Properties Realty Trust, Inc. (NYSE:EPRT) but similarly valued. These stocks are Armada Hoffler Properties Inc (NYSE:AHH), New York Mortgage Trust, Inc. (NASDAQ:NYMT), SRC Energy Inc. (NYSE:SRCI), and Orchard Therapeutics plc (NASDAQ:ORTX). This group of stocks’ market values are similar to EPRT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AHH | 9 | 66436 | -2 |

| NYMT | 10 | 20566 | 4 |

| SRCI | 19 | 304872 | 5 |

| ORTX | 21 | 304905 | 8 |

| Average | 14.75 | 174195 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $174 million. That figure was $111 million in EPRT’s case. Orchard Therapeutics plc (NASDAQ:ORTX) is the most popular stock in this table. On the other hand Armada Hoffler Properties Inc (NYSE:AHH) is the least popular one with only 9 bullish hedge fund positions. Essential Properties Realty Trust, Inc. (NYSE:EPRT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on EPRT as the stock returned 15.4% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.