As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and recouped their losses by the end of the first quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about EOG Resources Inc (NYSE:EOG).

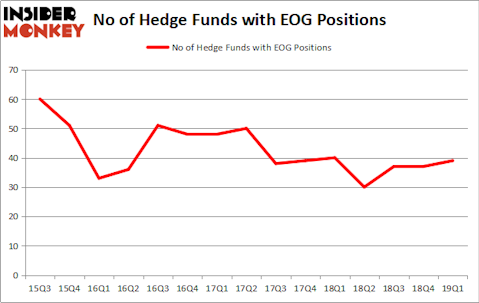

EOG Resources Inc (NYSE:EOG) was in 39 hedge funds’ portfolios at the end of March. EOG has experienced an increase in support from the world’s most elite money managers lately. There were 37 hedge funds in our database with EOG positions at the end of the previous quarter. Our calculations also showed that EOG isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are seen as underperforming, outdated financial vehicles of yesteryear. While there are greater than 8000 funds with their doors open at present, Our experts look at the masters of this club, approximately 750 funds. These hedge fund managers administer the lion’s share of the smart money’s total asset base, and by keeping track of their top stock picks, Insider Monkey has discovered numerous investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a look at the fresh hedge fund action regarding EOG Resources Inc (NYSE:EOG).

Hedge fund activity in EOG Resources Inc (NYSE:EOG)

Heading into the second quarter of 2019, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards EOG over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in EOG Resources Inc (NYSE:EOG) was held by Renaissance Technologies, which reported holding $253.3 million worth of stock at the end of March. It was followed by Two Sigma Advisors with a $217.8 million position. Other investors bullish on the company included Millennium Management, D E Shaw, and Arrowstreet Capital.

As one would reasonably expect, key hedge funds have jumped into EOG Resources Inc (NYSE:EOG) headfirst. HBK Investments, managed by David Costen Haley, initiated the largest position in EOG Resources Inc (NYSE:EOG). HBK Investments had $10.7 million invested in the company at the end of the quarter. Vince Maddi and Shawn Brennan’s SIR Capital Management also made a $5.5 million investment in the stock during the quarter. The following funds were also among the new EOG investors: David Costen Haley’s HBK Investments, Mike Vranos’s Ellington, and Jeffrey Talpins’s Element Capital Management.

Let’s now review hedge fund activity in other stocks similar to EOG Resources Inc (NYSE:EOG). We will take a look at The Southern Company (NYSE:SO), Boston Scientific Corporation (NYSE:BSX), Sony Corporation (NYSE:SNE), and Crown Castle International Corp. (NYSE:CCI). This group of stocks’ market values are closest to EOG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SO | 19 | 846857 | -1 |

| BSX | 47 | 2098911 | 1 |

| SNE | 22 | 569371 | -3 |

| CCI | 35 | 2190500 | 1 |

| Average | 30.75 | 1426410 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $1426 million. That figure was $1043 million in EOG’s case. Boston Scientific Corporation (NYSE:BSX) is the most popular stock in this table. On the other hand The Southern Company (NYSE:SO) is the least popular one with only 19 bullish hedge fund positions. EOG Resources Inc (NYSE:EOG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately EOG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EOG were disappointed as the stock returned -11.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.