Is Cullen/Frost Bankers, Inc. (NYSE:CFR) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

Cullen/Frost Bankers, Inc. (NYSE:CFR) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare CFR to other stocks including Macerich Company (NYSE:MAC), Parsley Energy Inc (NYSE:PE), and Helmerich & Payne, Inc. (NYSE:HP) to get a better sense of its popularity.

Today there are a multitude of metrics stock traders employ to grade their holdings. A duo of the most underrated metrics are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the top money managers can trounce the market by a significant margin (see the details here).

Matthew Hulsizer of PEAK6 Capital

Let’s go over the key hedge fund action surrounding Cullen/Frost Bankers, Inc. (NYSE:CFR).

What have hedge funds been doing with Cullen/Frost Bankers, Inc. (NYSE:CFR)?

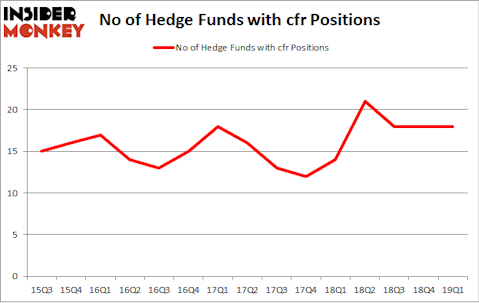

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in CFR over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Cullen/Frost Bankers, Inc. (NYSE:CFR), which was worth $17 million at the end of the first quarter. On the second spot was Yost Capital Management which amassed $12.4 million worth of shares. Moreover, Two Sigma Advisors, PEAK6 Capital Management, and GLG Partners were also bullish on Cullen/Frost Bankers, Inc. (NYSE:CFR), allocating a large percentage of their portfolios to this stock.

Seeing as Cullen/Frost Bankers, Inc. (NYSE:CFR) has faced a decline in interest from hedge fund managers, logic holds that there was a specific group of funds that slashed their full holdings last quarter. Intriguingly, Dmitry Balyasny’s Balyasny Asset Management dropped the biggest investment of all the hedgies watched by Insider Monkey, comprising close to $10.8 million in stock, and Ray Dalio’s Bridgewater Associates was right behind this move, as the fund dumped about $2 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cullen/Frost Bankers, Inc. (NYSE:CFR) but similarly valued. We will take a look at Macerich Company (NYSE:MAC), Parsley Energy Inc (NYSE:PE), Helmerich & Payne, Inc. (NYSE:HP), and USG Corporation (NYSE:USG). This group of stocks’ market caps match CFR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAC | 22 | 298493 | -3 |

| PE | 34 | 849803 | -2 |

| HP | 31 | 399271 | 4 |

| USG | 23 | 2358109 | 3 |

| Average | 27.5 | 976419 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $976 million. That figure was $66 million in CFR’s case. Parsley Energy Inc (NYSE:PE) is the most popular stock in this table. On the other hand Macerich Company (NYSE:MAC) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Cullen/Frost Bankers, Inc. (NYSE:CFR) is even less popular than MAC. Hedge funds dodged a bullet by taking a bearish stance towards CFR. Our calculations showed that the top 15 most popular hedge fund stocks returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CFR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CFR investors were disappointed as the stock returned -3.4% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.