The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards CONMED Corporation (NASDAQ:CNMD).

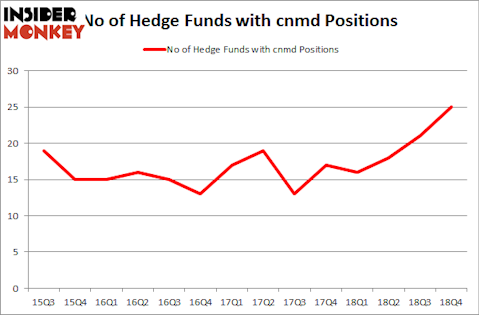

CONMED Corporation (NASDAQ:CNMD) has experienced an increase in support from the world’s most elite money managers in recent months. CNMD was in 25 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 21 hedge funds in our database with CNMD positions at the end of the previous quarter. Our calculations also showed that cnmd isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s analyze the new hedge fund action encompassing CONMED Corporation (NASDAQ:CNMD).

How have hedgies been trading CONMED Corporation (NASDAQ:CNMD)?

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CNMD over the last 14 quarters. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in CONMED Corporation (NASDAQ:CNMD) was held by Scopia Capital, which reported holding $62.2 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $37.2 million position. Other investors bullish on the company included Arrowstreet Capital, Point72 Asset Management, and Marshall Wace LLP.

As aggregate interest increased, key hedge funds have jumped into CONMED Corporation (NASDAQ:CNMD) headfirst. Point72 Asset Management, managed by Steve Cohen, assembled the largest position in CONMED Corporation (NASDAQ:CNMD). Point72 Asset Management had $10.3 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $10.3 million position during the quarter. The other funds with brand new CNMD positions are Matthew Hulsizer’s PEAK6 Capital Management, David Costen Haley’s HBK Investments, and Ronald Hua’s Qtron Investments.

Let’s check out hedge fund activity in other stocks similar to CONMED Corporation (NASDAQ:CNMD). These stocks are Ares Management Corporation (NYSE:ARES), Capitol Federal Financial, Inc. (NASDAQ:CFFN), ExlService Holdings, Inc. (NASDAQ:EXLS), and Great Western Bancorp Inc (NYSE:GWB). This group of stocks’ market values are closest to CNMD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARES | 11 | 206059 | -4 |

| CFFN | 9 | 160967 | -3 |

| EXLS | 11 | 36147 | 1 |

| GWB | 11 | 19420 | 3 |

| Average | 10.5 | 105648 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $180 million in CNMD’s case. Ares Management Corporation (NYSE:ARES) is the most popular stock in this table. On the other hand Capitol Federal Financial, Inc. (NASDAQ:CFFN) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks CONMED Corporation (NASDAQ:CNMD) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on CNMD, though not to the same extent, as the stock returned 23.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.