The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Compania de Minas Buenaventura SA (NYSE:BVN) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

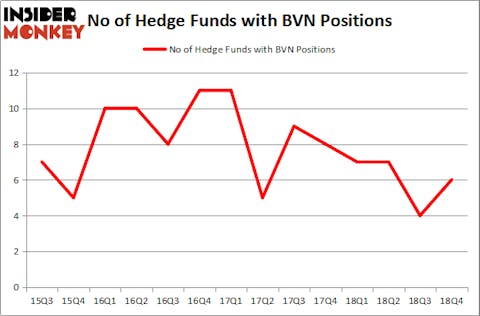

Compania de Minas Buenaventura SA (NYSE:BVN) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. BVN was in 6 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 4 hedge funds in our database with BVN holdings at the end of the previous quarter. Our calculations also showed that BVN isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several indicators market participants put to use to analyze publicly traded companies. Some of the most under-the-radar indicators are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can beat their index-focused peers by a solid margin (see the details here).

We’re going to take a look at the latest hedge fund action surrounding Compania de Minas Buenaventura SA (NYSE:BVN).

How are hedge funds trading Compania de Minas Buenaventura SA (NYSE:BVN)?

At Q4’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards BVN over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Prince Street Capital Management, managed by David Halpert, holds the largest position in Compania de Minas Buenaventura SA (NYSE:BVN). Prince Street Capital Management has a $11.3 million position in the stock, comprising 2.8% of its 13F portfolio. Sitting at the No. 2 spot is Eric Sprott of Sprott Asset Management, with a $5.5 million position; the fund has 1.5% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism comprise Matthew Hulsizer’s PEAK6 Capital Management, and Israel Englander’s Millennium Management.

Consequently, key money managers have jumped into Compania de Minas Buenaventura SA (NYSE:BVN) headfirst. Sprott Asset Management, managed by Eric Sprott, initiated the biggest position in Compania de Minas Buenaventura SA (NYSE:BVN). Sprott Asset Management had $5.5 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also initiated a $1.2 million position during the quarter. The other funds with brand new BVN positions are Matthew Tewksbury’s Stevens Capital Management and Bruce Kovner’s Caxton Associates LP.

Let’s now review hedge fund activity in other stocks similar to Compania de Minas Buenaventura SA (NYSE:BVN). We will take a look at Eaton Vance Corp (NYSE:EV), VEON Ltd. (NASDAQ:VEON), Portland General Electric Company (NYSE:POR), and Tesaro Inc (NASDAQ:TSRO). This group of stocks’ market values are closest to BVN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EV | 17 | 125546 | 2 |

| VEON | 9 | 27679 | 2 |

| POR | 19 | 249916 | 3 |

| TSRO | 39 | 1357819 | 19 |

| Average | 21 | 440240 | 6.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $440 million. That figure was $22 million in BVN’s case. Tesaro Inc (NASDAQ:TSRO) is the most popular stock in this table. On the other hand VEON Ltd. (NASDAQ:VEON) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Compania de Minas Buenaventura SA (NYSE:BVN) is even less popular than VEON. Hedge funds dodged a bullet by taking a bearish stance towards BVN. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BVN wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); BVN investors were disappointed as the stock returned -3.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.