World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

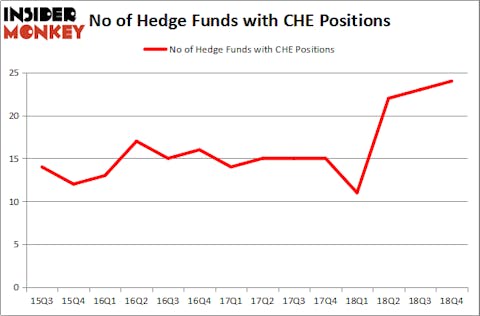

Chemed Corporation (NYSE:CHE) shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. CHE was in 24 hedge funds’ portfolios at the end of December. There were 23 hedge funds in our database with CHE holdings at the end of the previous quarter. Our calculations also showed that CHE isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are seen as worthless, old investment tools of years past. While there are more than 8000 funds in operation at present, Our researchers hone in on the bigwigs of this club, approximately 750 funds. These investment experts manage the majority of the smart money’s total capital, and by shadowing their matchless stock picks, Insider Monkey has found a few investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to go over the new hedge fund action surrounding Chemed Corporation (NYSE:CHE).

How have hedgies been trading Chemed Corporation (NYSE:CHE)?

At Q4’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CHE over the last 14 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Chemed Corporation (NYSE:CHE), with a stake worth $135.2 million reported as of the end of September. Trailing Fisher Asset Management was Renaissance Technologies, which amassed a stake valued at $73.6 million. GAMCO Investors, GLG Partners, and Point72 Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most outsized position in Chemed Corporation (NYSE:CHE). Marshall Wace LLP had $3.7 million invested in the company at the end of the quarter. Ronald Hua’s Qtron Investments also initiated a $0.3 million position during the quarter. The only other fund with a new position in the stock is Andre F. Perold’s HighVista Strategies.

Let’s check out hedge fund activity in other stocks similar to Chemed Corporation (NYSE:CHE). We will take a look at Teradata Corporation (NYSE:TDC), Catalent Inc (NYSE:CTLT), Fluor Corporation (NYSE:FLR), and RealPage, Inc. (NASDAQ:RP). This group of stocks’ market values match CHE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TDC | 21 | 211609 | -2 |

| CTLT | 19 | 235857 | -4 |

| FLR | 20 | 223293 | -3 |

| RP | 21 | 343809 | -6 |

| Average | 20.25 | 253642 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $254 million. That figure was $390 million in CHE’s case. Teradata Corporation (NYSE:TDC) is the most popular stock in this table. On the other hand Catalent Inc (NYSE:CTLT) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Chemed Corporation (NYSE:CHE) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CHE wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CHE were disappointed as the stock returned 12.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.