Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is CenterState Bank Corporation (NASDAQ:CSFL), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

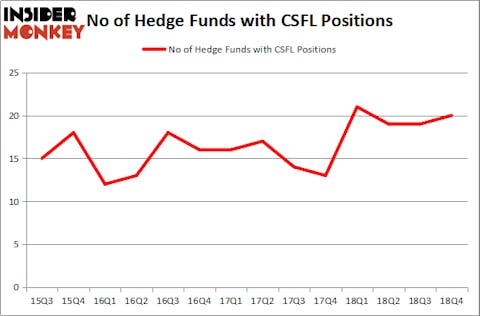

Is CenterState Bank Corporation (NASDAQ:CSFL) a safe investment right now? Prominent investors are becoming more confident. The number of bullish hedge fund bets advanced by 1 in recent months. Our calculations also showed that CSFL isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several signals investors put to use to assess stocks. Two of the most innovative signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the top fund managers can beat their index-focused peers by a significant margin (see the details here).

We’re going to take a look at the key hedge fund action surrounding CenterState Bank Corporation (NASDAQ:CSFL).

What have hedge funds been doing with CenterState Bank Corporation (NASDAQ:CSFL)?

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the second quarter of 2018. By comparison, 21 hedge funds held shares or bullish call options in CSFL a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of CenterState Bank Corporation (NASDAQ:CSFL), with a stake worth $32.6 million reported as of the end of December. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $17.5 million. Royce & Associates, Forest Hill Capital, and Marshall Wace LLP were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers have jumped into CenterState Bank Corporation (NASDAQ:CSFL) headfirst. Brant Point Investment Management, managed by Ira Unschuld, initiated the largest position in CenterState Bank Corporation (NASDAQ:CSFL). Brant Point Investment Management had $3.5 million invested in the company at the end of the quarter. Gregg Moskowitz’s Interval Partners also initiated a $2 million position during the quarter. The other funds with new positions in the stock are Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as CenterState Bank Corporation (NASDAQ:CSFL) but similarly valued. These stocks are Acceleron Pharma Inc (NASDAQ:XLRN), Brookfield Business Partners L.P. (NYSE:BBU), Albany International Corp. (NYSE:AIN), and PQ Group Holdings Inc. (NYSE:PQG). This group of stocks’ market caps are similar to CSFL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XLRN | 19 | 331684 | -8 |

| BBU | 4 | 15907 | -2 |

| AIN | 11 | 63419 | -2 |

| PQG | 4 | 64147 | -5 |

| Average | 9.5 | 118789 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $119 million. That figure was $109 million in CSFL’s case. Acceleron Pharma Inc (NASDAQ:XLRN) is the most popular stock in this table. On the other hand Brookfield Business Partners L.P. (NYSE:BBU) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks CenterState Bank Corporation (NASDAQ:CSFL) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CSFL wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CSFL were disappointed as the stock returned 16.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.