At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

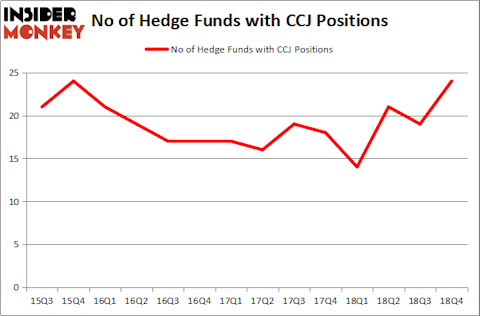

Cameco Corporation (NYSE:CCJ) was in 24 hedge funds’ portfolios at the end of December. CCJ has experienced an increase in support from the world’s most elite money managers of late. There were 19 hedge funds in our database with CCJ holdings at the end of the previous quarter. Our calculations also showed that CCJ isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action surrounding Cameco Corporation (NYSE:CCJ).

What does the smart money think about Cameco Corporation (NYSE:CCJ)?

At Q4’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CCJ over the last 14 quarters. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Cameco Corporation (NYSE:CCJ) was held by Kopernik Global Investors, which reported holding $107.9 million worth of stock at the end of September. It was followed by Adage Capital Management with a $107.7 million position. Other investors bullish on the company included Moerus Capital Management, Citadel Investment Group, and Yost Capital Management.

As one would reasonably expect, specific money managers have jumped into Cameco Corporation (NYSE:CCJ) headfirst. Moerus Capital Management, managed by Amit Wadhwaney, initiated the biggest position in Cameco Corporation (NYSE:CCJ). Moerus Capital Management had $18.1 million invested in the company at the end of the quarter. Rob Citrone’s Discovery Capital Management also made a $10.3 million investment in the stock during the quarter. The other funds with brand new CCJ positions are Mark Kingdon’s Kingdon Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and John Burbank’s Passport Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cameco Corporation (NYSE:CCJ) but similarly valued. These stocks are SAGE Therapeutics Inc (NASDAQ:SAGE), MongoDB, Inc. (NASDAQ:MDB), Curtiss-Wright Corp. (NYSE:CW), and United States Cellular Corporation (NYSE:USM). This group of stocks’ market caps are similar to CCJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAGE | 29 | 330966 | -8 |

| MDB | 23 | 510104 | 2 |

| CW | 20 | 355686 | -2 |

| USM | 17 | 208533 | 2 |

| Average | 22.25 | 351322 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $351 million. That figure was $346 million in CCJ’s case. SAGE Therapeutics Inc (NASDAQ:SAGE) is the most popular stock in this table. On the other hand United States Cellular Corporation (NYSE:USM) is the least popular one with only 17 bullish hedge fund positions. Cameco Corporation (NYSE:CCJ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CCJ wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CCJ were disappointed as the stock returned 4.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.