We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Cambridge Bancorp (NASDAQ:CATC).

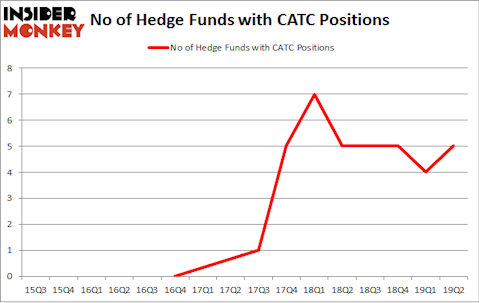

Cambridge Bancorp (NASDAQ:CATC) has seen an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that CATC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the fresh hedge fund action surrounding Cambridge Bancorp (NASDAQ:CATC).

What have hedge funds been doing with Cambridge Bancorp (NASDAQ:CATC)?

At Q2’s end, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the first quarter of 2019. By comparison, 5 hedge funds held shares or bullish call options in CATC a year ago. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Castine Capital Management was the largest shareholder of Cambridge Bancorp (NASDAQ:CATC), with a stake worth $10.7 million reported as of the end of March. Trailing Castine Capital Management was Polaris Capital Management, which amassed a stake valued at $4.5 million. Renaissance Technologies, GAMCO Investors, and Springbok Capital were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key money managers have jumped into Cambridge Bancorp (NASDAQ:CATC) headfirst. Springbok Capital, managed by Gavin Saitowitz and Cisco J. del Valle, created the most outsized position in Cambridge Bancorp (NASDAQ:CATC). Springbok Capital had $0 million invested in the company at the end of the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Cambridge Bancorp (NASDAQ:CATC). We will take a look at Westport Fuel Systems Inc. (NASDAQ:WPRT), Secoo Holding Limited (NASDAQ:SECO), Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB), and Chico’s FAS, Inc. (NYSE:CHS). This group of stocks’ market values match CATC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WPRT | 13 | 36374 | 1 |

| SECO | 7 | 18956 | -1 |

| RRGB | 12 | 31975 | -3 |

| CHS | 13 | 41230 | -2 |

| Average | 11.25 | 32134 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $17 million in CATC’s case. Westport Fuel Systems Inc. (NASDAQ:WPRT) is the most popular stock in this table. On the other hand Secoo Holding Limited (NASDAQ:SECO) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Cambridge Bancorp (NASDAQ:CATC) is even less popular than SECO. Hedge funds dodged a bullet by taking a bearish stance towards CATC. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CATC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CATC investors were disappointed as the stock returned -7.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.