Is Brown & Brown, Inc. (NYSE:BRO) good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profiles failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

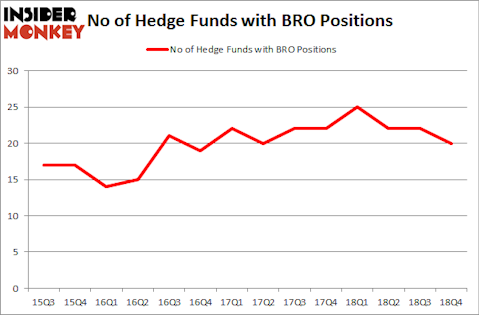

Is Brown & Brown, Inc. (NYSE:BRO) undervalued? The smart money is becoming less hopeful. The number of long hedge fund positions decreased by 2 in recent months. Our calculations also showed that BRO isn’t among the 30 most popular stocks among hedge funds. BRO was in 20 hedge funds’ portfolios at the end of December. There were 22 hedge funds in our database with BRO holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action encompassing Brown & Brown, Inc. (NYSE:BRO).

What does the smart money think about Brown & Brown, Inc. (NYSE:BRO)?

At the end of the fourth quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the previous quarter. On the other hand, there were a total of 25 hedge funds with a bullish position in BRO a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Select Equity Group was the largest shareholder of Brown & Brown, Inc. (NYSE:BRO), with a stake worth $258.6 million reported as of the end of September. Trailing Select Equity Group was Renaissance Technologies, which amassed a stake valued at $147.5 million. Polar Capital, Arrowstreet Capital, and Diamond Hill Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Brown & Brown, Inc. (NYSE:BRO) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedge funds who sold off their positions entirely by the end of the third quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management cut the biggest investment of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $4.2 million in stock. Zeke Ashton’s fund, Centaur Capital Partners, also dropped its stock, about $3.7 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Brown & Brown, Inc. (NYSE:BRO) but similarly valued. We will take a look at EXACT Sciences Corporation (NASDAQ:EXAS), National Retail Properties, Inc. (NYSE:NNN), The Ultimate Software Group, Inc. (NASDAQ:ULTI), and Spirit AeroSystems Holdings, Inc. (NYSE:SPR). This group of stocks’ market valuations resemble BRO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXAS | 30 | 672423 | -3 |

| NNN | 15 | 263404 | 4 |

| ULTI | 20 | 289161 | -5 |

| SPR | 32 | 2275785 | 0 |

| Average | 24.25 | 875193 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $875 million. That figure was $676 million in BRO’s case. Spirit AeroSystems Holdings, Inc. (NYSE:SPR) is the most popular stock in this table. On the other hand National Retail Properties, Inc. (NYSE:NNN) is the least popular one with only 15 bullish hedge fund positions. Brown & Brown, Inc. (NYSE:BRO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on.Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately BRO wasn’t in this group. Hedge funds that bet on BRO were disappointed as the stock returned 8.8% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.