Does Brown & Brown, Inc. (NYSE:BRO) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

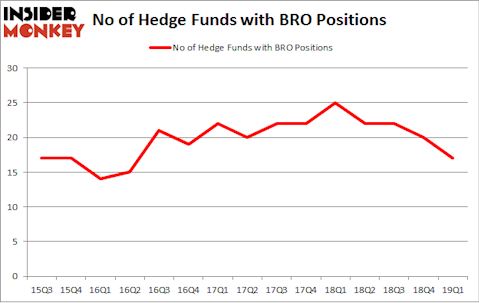

Is Brown & Brown, Inc. (NYSE:BRO) worth your attention right now? Prominent investors are in a pessimistic mood. The number of bullish hedge fund positions fell by 3 lately. Our calculations also showed that bro isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a lot of methods market participants put to use to value their holdings. Two of the less known methods are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the best money managers can beat the S&P 500 by a very impressive amount (see the details here).

Let’s view the fresh hedge fund action encompassing Brown & Brown, Inc. (NYSE:BRO).

Hedge fund activity in Brown & Brown, Inc. (NYSE:BRO)

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from the previous quarter. By comparison, 25 hedge funds held shares or bullish call options in BRO a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Among these funds, Select Equity Group held the most valuable stake in Brown & Brown, Inc. (NYSE:BRO), which was worth $275.4 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $132.2 million worth of shares. Moreover, Citadel Investment Group, Polar Capital, and Diamond Hill Capital were also bullish on Brown & Brown, Inc. (NYSE:BRO), allocating a large percentage of their portfolios to this stock.

Due to the fact that Brown & Brown, Inc. (NYSE:BRO) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of hedgies who sold off their full holdings heading into Q3. It’s worth mentioning that Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital dropped the largest position of the “upper crust” of funds followed by Insider Monkey, comprising close to $5.1 million in stock, and Nick Thakore’s Diametric Capital was right behind this move, as the fund sold off about $1.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 3 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Brown & Brown, Inc. (NYSE:BRO). These stocks are WEX Inc (NYSE:WEX), Gaming and Leisure Properties Inc (NASDAQ:GLPI), Graco Inc. (NYSE:GGG), and Black Knight, Inc. (NYSE:BKI). This group of stocks’ market valuations match BRO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WEX | 30 | 546702 | -2 |

| GLPI | 27 | 945964 | 0 |

| GGG | 18 | 180514 | 0 |

| BKI | 40 | 991316 | 4 |

| Average | 28.75 | 666124 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $666 million. That figure was $692 million in BRO’s case. Black Knight, Inc. (NYSE:BKI) is the most popular stock in this table. On the other hand Graco Inc. (NYSE:GGG) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Brown & Brown, Inc. (NYSE:BRO) is even less popular than GGG. Hedge funds clearly dropped the ball on BRO as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on BRO as the stock returned 12.6% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.