Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Bright Horizons Family Solutions Inc (NYSE:BFAM)? The smart money sentiment can provide an answer to this question.

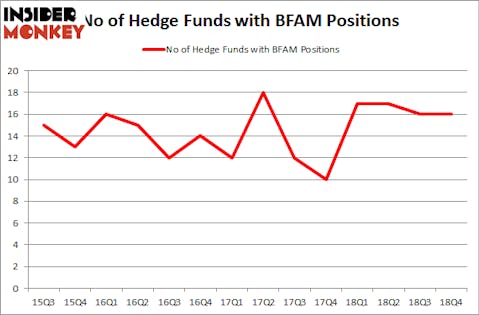

Bright Horizons Family Solutions Inc (NYSE:BFAM) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 16 hedge funds’ portfolios at the end of the fourth quarter of 2018. At the end of this article we will also compare BFAM to other stocks including Ingredion Inc (NYSE:INGR), Bausch Health Companies (NYSE:BHC), and AMERCO (NASDAQ:UHAL) to get a better sense of its popularity.

In the eyes of most stock holders, hedge funds are seen as underperforming, old investment tools of the past. While there are more than 8000 funds with their doors open at present, Our experts look at the bigwigs of this club, around 750 funds. These investment experts oversee most of the hedge fund industry’s total asset base, and by shadowing their top picks, Insider Monkey has spotted several investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Cliff Asness of AQR Capital Management

Let’s go over the new hedge fund action surrounding Bright Horizons Family Solutions Inc (NYSE:BFAM).

How have hedgies been trading Bright Horizons Family Solutions Inc (NYSE:BFAM)?

At Q4’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in BFAM a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Select Equity Group was the largest shareholder of Bright Horizons Family Solutions Inc (NYSE:BFAM), with a stake worth $182.9 million reported as of the end of September. Trailing Select Equity Group was Marshall Wace LLP, which amassed a stake valued at $51.9 million. D E Shaw, AQR Capital Management, and Bishop Rock Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Because Bright Horizons Family Solutions Inc (NYSE:BFAM) has faced bearish sentiment from hedge fund managers, it’s easy to see that there exists a select few funds who were dropping their entire stakes in the third quarter. Intriguingly, Benjamin A. Smith’s Laurion Capital Management cut the largest stake of the 700 funds watched by Insider Monkey, valued at close to $7 million in stock. Peter Muller’s fund, PDT Partners, also said goodbye to its stock, about $3.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Bright Horizons Family Solutions Inc (NYSE:BFAM). We will take a look at Ingredion Inc (NYSE:INGR), Bausch Health Companies (NYSE:BHC), AMERCO (NASDAQ:UHAL), and Unum Group (NYSE:UNM). This group of stocks’ market values are similar to BFAM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INGR | 21 | 235894 | 0 |

| BHC | 32 | 1348483 | 2 |

| UHAL | 7 | 348384 | -1 |

| UNM | 25 | 291468 | 0 |

| Average | 21.25 | 556057 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $556 million. That figure was $279 million in BFAM’s case. Bausch Health Companies (NYSE:BHC) is the most popular stock in this table. On the other hand AMERCO (NASDAQ:UHAL) is the least popular one with only 7 bullish hedge fund positions. Bright Horizons Family Solutions Inc (NYSE:BFAM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately BFAM wasn’t in this group. Hedge funds that bet on BFAM were disappointed as the stock returned 14.6% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.