Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

Avianca Holdings SA (NYSE:AVH) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 4 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as AquaVenture Holdings Limited (NYSE:WAAS), Bridge Bancorp, Inc. (NASDAQ:BDGE), and Enphase Energy Inc (NASDAQ:ENPH) to gather more data points.

At the moment there are dozens of metrics investors have at their disposal to grade publicly traded companies. Some of the less known metrics are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the top money managers can outclass their index-focused peers by a very impressive amount (see the details here).

We’re going to analyze the recent hedge fund action encompassing Avianca Holdings SA (NYSE:AVH).

What have hedge funds been doing with Avianca Holdings SA (NYSE:AVH)?

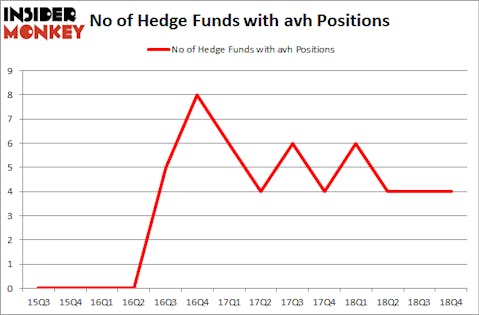

Heading into the first quarter of 2019, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in AVH over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the most valuable position in Avianca Holdings SA (NYSE:AVH), worth close to $5.6 million, accounting for less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is D E Shaw, led by D. E. Shaw, holding a $0.1 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, Ken Griffin’s Citadel Investment Group and .

Due to the fact that Avianca Holdings SA (NYSE:AVH) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies that elected to cut their full holdings heading into Q3. Interestingly, David Halpert’s Prince Street Capital Management cut the largest position of the “upper crust” of funds followed by Insider Monkey, comprising about $1 million in stock. Israel Englander’s fund, Millennium Management, also dumped its stock, about $0.9 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Avianca Holdings SA (NYSE:AVH) but similarly valued. These stocks are AquaVenture Holdings Limited (NYSE:WAAS), Bridge Bancorp, Inc. (NASDAQ:BDGE), Enphase Energy Inc (NASDAQ:ENPH), and Capitol Investment Corp. IV (NYSE:CIC). This group of stocks’ market valuations resemble AVH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAAS | 11 | 26946 | -1 |

| BDGE | 9 | 86830 | -2 |

| ENPH | 18 | 93097 | -1 |

| CIC | 14 | 162175 | -1 |

| Average | 13 | 92262 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $6 million in AVH’s case. Enphase Energy Inc (NASDAQ:ENPH) is the most popular stock in this table. On the other hand Bridge Bancorp, Inc. (NASDAQ:BDGE) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Avianca Holdings SA (NYSE:AVH) is even less popular than BDGE. Hedge funds dodged a bullet by taking a bearish stance towards AVH. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately AVH wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); AVH investors were disappointed as the stock returned -2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.