Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

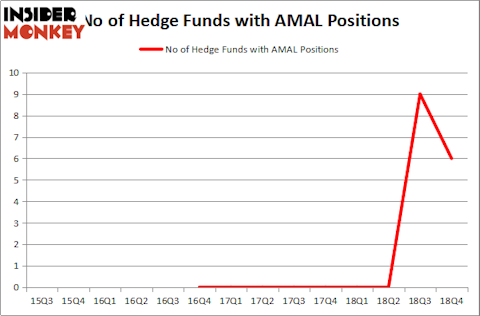

Amalgamated Bank (NASDAQ:AMAL) has experienced a decrease in support from the world’s most elite money managers recently. Our calculations also showed that AMAL isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most investors, hedge funds are seen as worthless, old financial vehicles of yesteryear. While there are greater than 8000 funds in operation at present, Our researchers look at the aristocrats of this club, around 750 funds. These investment experts watch over most of the smart money’s total asset base, and by paying attention to their best picks, Insider Monkey has spotted a number of investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s go over the recent hedge fund action surrounding Amalgamated Bank (NASDAQ:AMAL).

What have hedge funds been doing with Amalgamated Bank (NASDAQ:AMAL)?

At the end of the fourth quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -33% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in AMAL a year ago. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Among these funds, Invesco Private Capital (WL Ross) held the most valuable stake in Amalgamated Bank (NASDAQ:AMAL), which was worth $29.3 million at the end of the fourth quarter. On the second spot was Mendon Capital Advisors which amassed $14 million worth of shares. Moreover, Millennium Management, Azora Capital, and Adage Capital Management were also bullish on Amalgamated Bank (NASDAQ:AMAL), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Amalgamated Bank (NASDAQ:AMAL) has faced falling interest from the entirety of the hedge funds we track, it’s safe to say that there were a few hedgies that decided to sell off their full holdings in the third quarter. Intriguingly, Dmitry Balyasny’s Balyasny Asset Management sold off the largest stake of all the hedgies tracked by Insider Monkey, comprising about $2 million in stock. Ken Griffin’s fund, Citadel Investment Group, also cut its stock, about $1.4 million worth. These transactions are interesting, as total hedge fund interest dropped by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Amalgamated Bank (NASDAQ:AMAL) but similarly valued. These stocks are Dime Community Bancshares, Inc. (NASDAQ:DCOM), SpartanNash Company (NASDAQ:SPTN), Lindblad Expeditions Holdings Inc (NASDAQ:LIND), and IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP). This group of stocks’ market values match AMAL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCOM | 9 | 35352 | -4 |

| SPTN | 16 | 39053 | 2 |

| LIND | 14 | 108364 | 0 |

| IRCP | 5 | 11395 | 2 |

| Average | 11 | 48541 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $49 million. That figure was $71 million in AMAL’s case. SpartanNash Company (NASDAQ:SPTN) is the most popular stock in this table. On the other hand IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP) is the least popular one with only 5 bullish hedge fund positions. Amalgamated Bank (NASDAQ:AMAL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately AMAL wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); AMAL investors were disappointed as the stock returned -19.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.