Does AK Steel Holding Corporation (NYSE:AKS) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

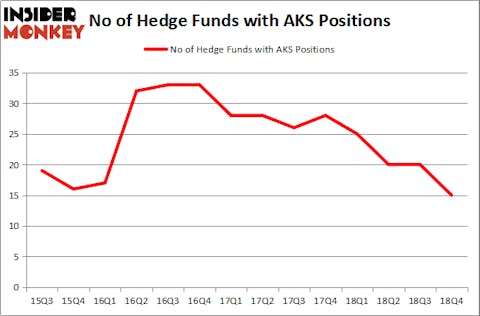

AK Steel Holding Corporation (NYSE:AKS) has seen a decrease in activity from the world’s largest hedge funds of late. Our calculations also showed that AKS isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the new hedge fund action encompassing AK Steel Holding Corporation (NYSE:AKS).

Hedge fund activity in AK Steel Holding Corporation (NYSE:AKS)

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -25% from one quarter earlier. By comparison, 25 hedge funds held shares or bullish call options in AKS a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in AK Steel Holding Corporation (NYSE:AKS) was held by Millennium Management, which reported holding $9.2 million worth of stock at the end of December. It was followed by GLG Partners with a $4.6 million position. Other investors bullish on the company included DC Capital Partners, Royce & Associates, and Carlson Capital.

Since AK Steel Holding Corporation (NYSE:AKS) has experienced a decline in interest from the entirety of the hedge funds we track, logic holds that there exists a select few hedge funds that decided to sell off their positions entirely last quarter. Interestingly, Philip Rosenstrach’s Pomelo Capital said goodbye to the largest position of all the hedgies monitored by Insider Monkey, totaling an estimated $16.4 million in stock. Alec Litowitz and Ross Laser’s fund, Magnetar Capital, also dumped its stock, about $9 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as AK Steel Holding Corporation (NYSE:AKS) but similarly valued. We will take a look at Central Pacific Financial Corp. (NYSE:CPF), Fidelity Southern Corporation (NASDAQ:LION), Cellectis SA (NASDAQ:CLLS), and Maxar Technologies Ltd. (NYSE:MAXR). All of these stocks’ market caps resemble AKS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPF | 14 | 65168 | 2 |

| LION | 9 | 57537 | 0 |

| CLLS | 8 | 33807 | -5 |

| MAXR | 8 | 5833 | 1 |

| Average | 9.75 | 40586 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $29 million in AKS’s case. Central Pacific Financial Corp. (NYSE:CPF) is the most popular stock in this table. On the other hand Cellectis SA (NASDAQ:CLLS) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks AK Steel Holding Corporation (NYSE:AKS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately AKS wasn’t nearly as popular as these 15 stock and hedge funds that were betting on AKS were disappointed as the stock returned 8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.