Is Finisar Corporation (NASDAQ:FNSR) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

Hedge fund interest in Finisar Corporation (NASDAQ:FNSR) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare FNSR to other stocks including Resideo Technologies, Inc. (NYSE:REZI), Outfront Media Inc (NYSE:OUT), and Balchem Corporation (NASDAQ:BCPC) to get a better sense of its popularity.

If you’d ask most investors, hedge funds are viewed as unimportant, outdated investment vehicles of yesteryear. While there are over 8000 funds in operation at the moment, Our researchers look at the masters of this group, about 750 funds. These investment experts orchestrate the lion’s share of all hedge funds’ total capital, and by monitoring their top picks, Insider Monkey has formulated a number of investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a glance at the latest hedge fund action surrounding Finisar Corporation (NASDAQ:FNSR).

Hedge fund activity in Finisar Corporation (NASDAQ:FNSR)

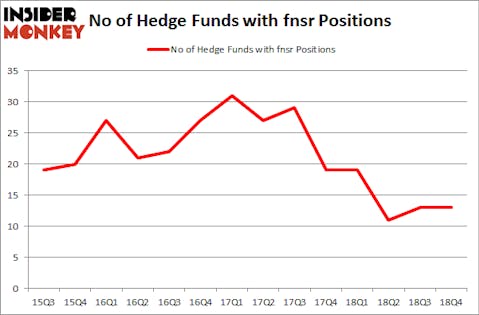

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FNSR over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Magnetar Capital, managed by Alec Litowitz and Ross Laser, holds the most valuable position in Finisar Corporation (NASDAQ:FNSR). Magnetar Capital has a $125.8 million position in the stock, comprising 3.1% of its 13F portfolio. The second largest stake is held by Alpine Associates, managed by Robert Emil Zoellner, which holds a $85.6 million position; 3.6% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions include Ken Fisher’s Fisher Asset Management, Chuck Royce’s Royce & Associates and Matthew Tewksbury’s Stevens Capital Management.

Due to the fact that Finisar Corporation (NASDAQ:FNSR) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there is a sect of money managers that elected to cut their full holdings heading into Q3. It’s worth mentioning that Steve Cohen’s Point72 Asset Management dropped the largest position of the “upper crust” of funds tracked by Insider Monkey, comprising about $11.2 million in stock. Joseph A. Jolson’s fund, Harvest Capital Strategies, also dumped its stock, about $9.8 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Finisar Corporation (NASDAQ:FNSR) but similarly valued. These stocks are Resideo Technologies, Inc. (NYSE:REZI), Outfront Media Inc (NYSE:OUT), Balchem Corporation (NASDAQ:BCPC), and American Equity Investment Life Holding Company (NYSE:AEL). This group of stocks’ market caps resemble FNSR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REZI | 35 | 414766 | 35 |

| OUT | 17 | 234362 | 4 |

| BCPC | 11 | 57081 | 3 |

| AEL | 17 | 112145 | 4 |

| Average | 20 | 204589 | 11.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $205 million. That figure was $323 million in FNSR’s case. Resideo Technologies, Inc. (NYSE:REZI) is the most popular stock in this table. On the other hand Balchem Corporation (NASDAQ:BCPC) is the least popular one with only 11 bullish hedge fund positions. Finisar Corporation (NASDAQ:FNSR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FNSR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); FNSR investors were disappointed as the stock returned 12.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.