At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

BP Prudhoe Bay Royalty Trust (NYSE:BPT) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 4 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Arrow Financial Corporation (NASDAQ:AROW), Barings BDC, Inc. (NYSE:BBDC), and A10 Networks Inc (NYSE:ATEN) to gather more data points.

If you’d ask most traders, hedge funds are perceived as slow, old investment tools of yesteryear. While there are more than 8000 funds with their doors open today, We look at the top tier of this club, about 750 funds. These hedge fund managers preside over bulk of all hedge funds’ total capital, and by observing their highest performing equity investments, Insider Monkey has determined many investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a gander at the key hedge fund action encompassing BP Prudhoe Bay Royalty Trust (NYSE:BPT).

How are hedge funds trading BP Prudhoe Bay Royalty Trust (NYSE:BPT)?

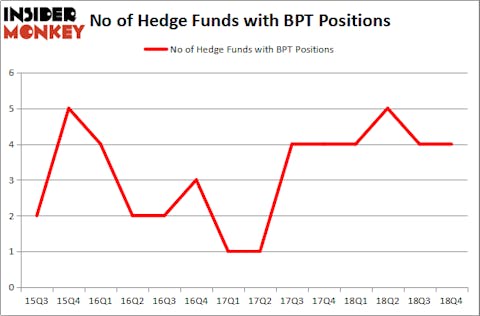

At the end of the fourth quarter, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards BPT over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Two Sigma Advisors was the largest shareholder of BP Prudhoe Bay Royalty Trust (NYSE:BPT), with a stake worth $1.9 million reported as of the end of December. Trailing Two Sigma Advisors was Renaissance Technologies, which amassed a stake valued at $1.5 million. Arrowstreet Capital and Citadel Investment Group also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: HBK Investments. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Renaissance Technologies).

Let’s go over hedge fund activity in other stocks similar to BP Prudhoe Bay Royalty Trust (NYSE:BPT). We will take a look at Arrow Financial Corporation (NASDAQ:AROW), Barings BDC, Inc. (NYSE:BBDC), A10 Networks Inc (NYSE:ATEN), and NuCana plc (NASDAQ:NCNA). This group of stocks’ market valuations resemble BPT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AROW | 3 | 11071 | -1 |

| BBDC | 10 | 11904 | 1 |

| ATEN | 17 | 84026 | 2 |

| NCNA | 2 | 33531 | -2 |

| Average | 8 | 35133 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $5 million in BPT’s case. A10 Networks Inc (NYSE:ATEN) is the most popular stock in this table. On the other hand NuCana plc (NASDAQ:NCNA) is the least popular one with only 2 bullish hedge fund positions. BP Prudhoe Bay Royalty Trust (NYSE:BPT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BPT wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); BPT investors were disappointed as the stock returned 11.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.