Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

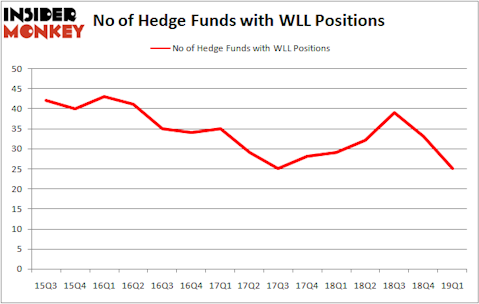

Whiting Petroleum Corporation (NYSE:WLL) was in 25 hedge funds’ portfolios at the end of the first quarter of 2019. WLL shareholders have witnessed a decrease in hedge fund sentiment recently. There were 33 hedge funds in our database with WLL positions at the end of the previous quarter. Our calculations also showed that WLL isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are several gauges shareholders employ to value stocks. Some of the most under-the-radar gauges are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best money managers can beat their index-focused peers by a superb margin (see the details here).

Let’s check out the key hedge fund action encompassing Whiting Petroleum Corporation (NYSE:WLL).

What have hedge funds been doing with Whiting Petroleum Corporation (NYSE:WLL)?

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -24% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in WLL over the last 15 quarters. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Fine Capital Partners was the largest shareholder of Whiting Petroleum Corporation (NYSE:WLL), with a stake worth $100.1 million reported as of the end of March. Trailing Fine Capital Partners was Citadel Investment Group, which amassed a stake valued at $54.7 million. GMT Capital, Renaissance Technologies, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since Whiting Petroleum Corporation (NYSE:WLL) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there were a few money managers who were dropping their positions entirely last quarter. At the top of the heap, Todd J. Kantor’s Encompass Capital Advisors cut the largest investment of all the hedgies followed by Insider Monkey, comprising close to $37.6 million in stock, and Ken Heebner’s Capital Growth Management was right behind this move, as the fund sold off about $31.8 million worth. These moves are important to note, as total hedge fund interest dropped by 8 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Whiting Petroleum Corporation (NYSE:WLL) but similarly valued. These stocks are AAON, Inc. (NASDAQ:AAON), Argo Group International Holdings, Ltd. (NYSE:ARGO), El Paso Electric Company (NYSE:EE), and WESCO International, Inc. (NYSE:WCC). All of these stocks’ market caps are similar to WLL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AAON | 5 | 3625 | -1 |

| ARGO | 17 | 200431 | 4 |

| EE | 22 | 348987 | -1 |

| WCC | 26 | 467300 | 0 |

| Average | 17.5 | 255086 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $361 million in WLL’s case. WESCO International, Inc. (NYSE:WCC) is the most popular stock in this table. On the other hand AAON, Inc. (NASDAQ:AAON) is the least popular one with only 5 bullish hedge fund positions. Whiting Petroleum Corporation (NYSE:WLL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WLL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WLL were disappointed as the stock returned -27.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.