There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze United Community Banks Inc (NASDAQ:UCBI).

Hedge fund interest in United Community Banks Inc (NASDAQ:UCBI) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare UCBI to other stocks including Brinker International, Inc. (NYSE:EAT), Cloudera, Inc. (NYSE:CLDR), and ServisFirst Bancshares, Inc. (NASDAQ:SFBS) to get a better sense of its popularity.

To the average investor there are several gauges investors have at their disposal to evaluate their holdings. A pair of the best gauges are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the top fund managers can trounce the broader indices by a significant margin (see the details here).

Let’s take a peek at the latest hedge fund action surrounding United Community Banks Inc (NASDAQ:UCBI).

What have hedge funds been doing with United Community Banks Inc (NASDAQ:UCBI)?

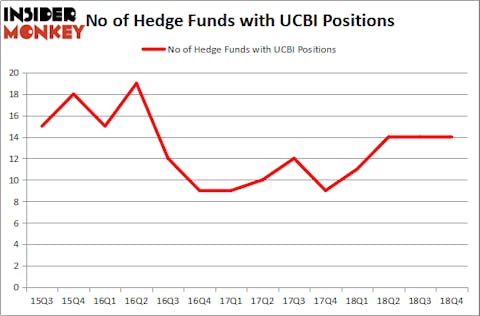

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in UCBI over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of United Community Banks Inc (NASDAQ:UCBI), with a stake worth $30 million reported as of the end of December. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $22.3 million. D E Shaw, AQR Capital Management, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that United Community Banks Inc (NASDAQ:UCBI) has experienced a decline in interest from the smart money, we can see that there is a sect of hedge funds that decided to sell off their positions entirely heading into Q3. At the top of the heap, Brandon Haley’s Holocene Advisors dropped the biggest investment of the 700 funds watched by Insider Monkey, totaling close to $0.9 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dropped its stock, about $0.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as United Community Banks Inc (NASDAQ:UCBI) but similarly valued. We will take a look at Brinker International, Inc. (NYSE:EAT), Cloudera, Inc. (NYSE:CLDR), ServisFirst Bancshares, Inc. (NASDAQ:SFBS), and Dycom Industries, Inc. (NYSE:DY). This group of stocks’ market valuations resemble UCBI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EAT | 26 | 166479 | 0 |

| CLDR | 26 | 132557 | 1 |

| SFBS | 11 | 10362 | 3 |

| DY | 18 | 125784 | -5 |

| Average | 20.25 | 108796 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $71 million in UCBI’s case. Brinker International, Inc. (NYSE:EAT) is the most popular stock in this table. On the other hand ServisFirst Bancshares, Inc. (NASDAQ:SFBS) is the least popular one with only 11 bullish hedge fund positions. United Community Banks Inc (NASDAQ:UCBI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on UCBI, though not to the same extent, as the stock returned 23.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.