The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at UMH Properties, Inc (NYSE:UMH) from the perspective of those elite funds.

Hedge fund interest in UMH Properties, Inc (NYSE:UMH) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Nine Energy Service, Inc. (NYSE:NINE), Independent Bank Corporation (NASDAQ:IBCP), and Barnes & Noble, Inc. (NYSE:BKS) to gather more data points. Our calculations also showed that UMH isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are viewed as worthless, outdated investment vehicles of the past. While there are more than 8000 funds with their doors open today, We hone in on the masters of this group, approximately 750 funds. These investment experts manage the lion’s share of the smart money’s total asset base, and by monitoring their first-class stock picks, Insider Monkey has determined a number of investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the fresh hedge fund action regarding UMH Properties, Inc (NYSE:UMH).

What have hedge funds been doing with UMH Properties, Inc (NYSE:UMH)?

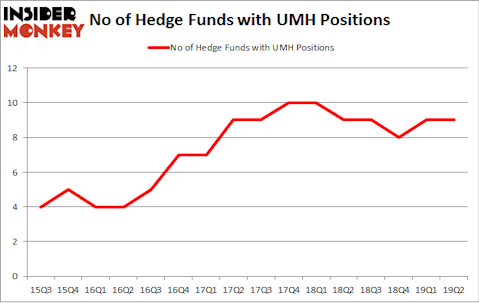

At the end of the second quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in UMH over the last 16 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in UMH Properties, Inc (NYSE:UMH) was held by Rutabaga Capital Management, which reported holding $4.4 million worth of stock at the end of March. It was followed by Millennium Management with a $3.2 million position. Other investors bullish on the company included Citadel Investment Group, Renaissance Technologies, and GAMCO Investors.

Due to the fact that UMH Properties, Inc (NYSE:UMH) has experienced bearish sentiment from hedge fund managers, it’s safe to say that there lies a certain “tier” of hedge funds that slashed their positions entirely heading into Q3. It’s worth mentioning that David Harding’s Winton Capital Management dropped the largest position of the “upper crust” of funds followed by Insider Monkey, valued at close to $0.4 million in stock, and Richard Driehaus’s Driehaus Capital was right behind this move, as the fund sold off about $0.2 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as UMH Properties, Inc (NYSE:UMH) but similarly valued. These stocks are Nine Energy Service, Inc. (NYSE:NINE), Independent Bank Corporation (NASDAQ:IBCP), Barnes & Noble, Inc. (NYSE:BKS), and First Financial Corporation (NASDAQ:THFF). This group of stocks’ market valuations resemble UMH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NINE | 6 | 37428 | -4 |

| IBCP | 11 | 46909 | 0 |

| BKS | 12 | 40157 | -6 |

| THFF | 9 | 14616 | 2 |

| Average | 9.5 | 34778 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $13 million in UMH’s case. Barnes & Noble, Inc. (NYSE:BKS) is the most popular stock in this table. On the other hand Nine Energy Service, Inc. (NYSE:NINE) is the least popular one with only 6 bullish hedge fund positions. UMH Properties, Inc (NYSE:UMH) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on UMH as the stock returned 15.1% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.