We can judge whether The RMR Group Inc. (NASDAQ:RMR) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

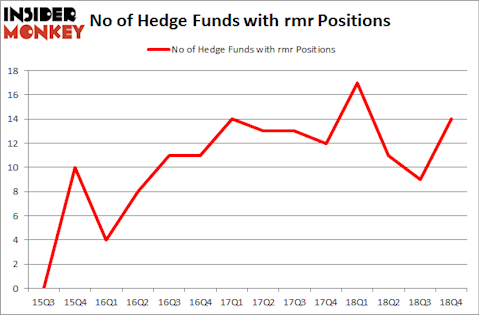

Is The RMR Group Inc. (NASDAQ:RMR) going to take off soon? The smart money is taking a bullish view. The number of bullish hedge fund positions inched up by 5 in recent months. Our calculations also showed that rmr isn’t among the 30 most popular stocks among hedge funds. RMR was in 14 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with RMR positions at the end of the previous quarter.

In the 21st century investor’s toolkit there are many indicators stock traders use to grade their stock investments. A pair of the less known indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite money managers can outclass the S&P 500 by a very impressive amount (see the details here).

We’re going to analyze the fresh hedge fund action regarding The RMR Group Inc. (NASDAQ:RMR).

What have hedge funds been doing with The RMR Group Inc. (NASDAQ:RMR)?

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 56% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RMR over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of The RMR Group Inc. (NASDAQ:RMR), with a stake worth $16.6 million reported as of the end of December. Trailing Renaissance Technologies was Gobi Capital, which amassed a stake valued at $8.2 million. Hawk Ridge Management, Royce & Associates, and Marshall Wace LLP were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Gobi Capital, managed by Bo Shan, assembled the most valuable position in The RMR Group Inc. (NASDAQ:RMR). Gobi Capital had $8.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $2.8 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group and D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The RMR Group Inc. (NASDAQ:RMR) but similarly valued. These stocks are LTC Properties Inc (NYSE:LTC), Advanced Energy Industries, Inc. (NASDAQ:AEIS), The Hain Celestial Group, Inc. (NASDAQ:HAIN), and Signet Jewelers Limited (NYSE:SIG). This group of stocks’ market values match RMR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LTC | 12 | 35330 | 3 |

| AEIS | 15 | 137880 | -4 |

| HAIN | 21 | 282907 | -2 |

| SIG | 21 | 200232 | -5 |

| Average | 17.25 | 164087 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $164 million. That figure was $42 million in RMR’s case. The Hain Celestial Group, Inc. (NASDAQ:HAIN) is the most popular stock in this table. On the other hand LTC Properties Inc (NYSE:LTC) is the least popular one with only 12 bullish hedge fund positions. The RMR Group Inc. (NASDAQ:RMR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately RMR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); RMR investors were disappointed as the stock returned 9.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.