The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 873 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 30th holdings, data that is available nowhere else. Should you consider Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. Our calculations also showed that ERIC isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA), DexCom, Inc. (NASDAQ:DXCM), and Kinder Morgan Inc (NYSE:KMI) to gather more data points.

In the eyes of most investors, hedge funds are perceived as underperforming, outdated investment tools of yesteryear. While there are more than 8000 funds with their doors open at present, Our experts look at the top tier of this group, approximately 850 funds. These money managers have their hands on the lion’s share of the smart money’s total capital, and by following their highest performing stock picks, Insider Monkey has figured out numerous investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Donald Sussman of Paloma Partners

Keeping this in mind we’re going to take a look at the recent hedge fund action encompassing Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC).

Do Hedge Funds Think ERIC Is A Good Stock To Buy Now?

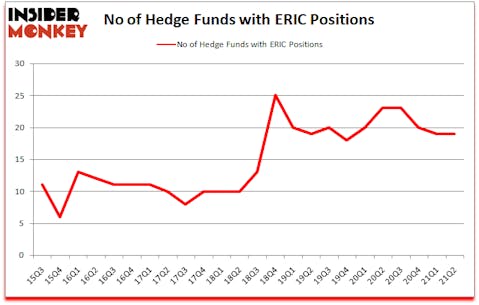

At second quarter’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ERIC over the last 24 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC), with a stake worth $57.7 million reported as of the end of June. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $43.5 million. Arrowstreet Capital, Cavalry Asset Management, and Ulysses Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Cavalry Asset Management allocated the biggest weight to Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC), around 3.57% of its 13F portfolio. Ulysses Management is also relatively very bullish on the stock, setting aside 1.63 percent of its 13F equity portfolio to ERIC.

Judging by the fact that Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) has faced bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of fund managers who sold off their full holdings by the end of the second quarter. Intriguingly, Steve Cohen’s Point72 Asset Management dumped the biggest stake of the “upper crust” of funds followed by Insider Monkey, comprising about $25 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund said goodbye to about $13 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC). We will take a look at Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA), DexCom, Inc. (NASDAQ:DXCM), Kinder Morgan Inc (NYSE:KMI), DuPont de Nemours Inc (NYSE:DD), Electronic Arts Inc. (NASDAQ:EA), American International Group Inc (NYSE:AIG), and Barclays PLC (NYSE:BCS). This group of stocks’ market valuations resemble ERIC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBVA | 9 | 274525 | 2 |

| DXCM | 49 | 1634192 | -7 |

| KMI | 38 | 1032764 | 0 |

| DD | 57 | 1653192 | 8 |

| EA | 56 | 2022602 | 12 |

| AIG | 39 | 2744991 | 6 |

| BCS | 11 | 119955 | 1 |

| Average | 37 | 1354603 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37 hedge funds with bullish positions and the average amount invested in these stocks was $1355 million. That figure was $229 million in ERIC’s case. DuPont de Nemours Inc (NYSE:DD) is the most popular stock in this table. On the other hand Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA) is the least popular one with only 9 bullish hedge fund positions. Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ERIC is 38.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and surpassed the market again by 1.6 percentage points. Unfortunately ERIC wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); ERIC investors were disappointed as the stock returned -7% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Ericsson L M Telephone Co (NASDAQ:ERIC)

Follow Ericsson L M Telephone Co (NASDAQ:ERIC)

Receive real-time insider trading and news alerts

Suggested Articles:

- Billionaire David Siegel’s Top 10 Stock Picks

- 15 Biggest Water Treatment Companies In The World

- 30 Most Religious Cities in the US

Disclosure: None. This article was originally published at Insider Monkey.