There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze T. Rowe Price Group, Inc. (NASDAQ:TROW).

T. Rowe Price Group, Inc. (NASDAQ:TROW) has seen an increase in hedge fund interest of late. Our calculations also showed that TROW isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are viewed as underperforming, old financial tools of years past. While there are more than 8000 funds trading at the moment, Our researchers choose to focus on the bigwigs of this club, about 750 funds. It is estimated that this group of investors preside over most of the hedge fund industry’s total capital, and by observing their top stock picks, Insider Monkey has discovered several investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to review the latest hedge fund action encompassing T. Rowe Price Group, Inc. (NASDAQ:TROW).

How have hedgies been trading T. Rowe Price Group, Inc. (NASDAQ:TROW)?

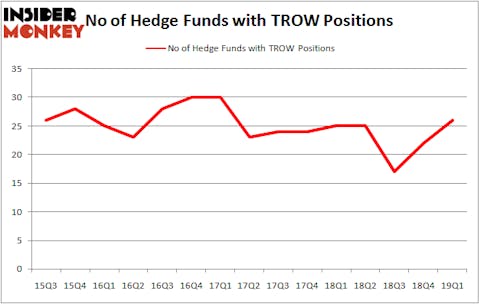

Heading into the second quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in TROW over the last 15 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, Millennium Management held the most valuable stake in T. Rowe Price Group, Inc. (NASDAQ:TROW), which was worth $167.7 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $122.3 million worth of shares. Moreover, Citadel Investment Group, AQR Capital Management, and Markel Gayner Asset Management were also bullish on T. Rowe Price Group, Inc. (NASDAQ:TROW), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers have been driving this bullishness. Junto Capital Management, managed by James Parsons, created the biggest position in T. Rowe Price Group, Inc. (NASDAQ:TROW). Junto Capital Management had $18.5 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $3.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Jeffrey Talpins’s Element Capital Management, and Brandon Haley’s Holocene Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as T. Rowe Price Group, Inc. (NASDAQ:TROW) but similarly valued. These stocks are PACCAR Inc (NASDAQ:PCAR), Waste Connections, Inc. (NYSE:WCN), Discover Financial Services (NYSE:DFS), and Fiat Chrysler Automobiles NV (NYSE:FCAU). This group of stocks’ market valuations are similar to TROW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PCAR | 23 | 94730 | 4 |

| WCN | 26 | 545837 | -2 |

| DFS | 36 | 742031 | -1 |

| FCAU | 27 | 2246774 | -7 |

| Average | 28 | 907343 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $907 million. That figure was $520 million in TROW’s case. Discover Financial Services (NYSE:DFS) is the most popular stock in this table. On the other hand PACCAR Inc (NASDAQ:PCAR) is the least popular one with only 23 bullish hedge fund positions. T. Rowe Price Group, Inc. (NASDAQ:TROW) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on TROW as the stock returned 2.5% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.