The market has been volatile in the last 6 months as the Federal Reserve continued its rate hikes and then abruptly reversed its stance and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q4 and the beginning of Q1. In this article, we analyze what the smart money thinks of Stifel Financial Corp. (NYSE:SF) and find out how it is affected by hedge funds’ moves.

Is Stifel Financial Corp. (NYSE:SF) undervalued? The smart money is getting more bullish. The number of bullish hedge fund positions went up by 4 recently. Our calculations also showed that sf isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are many methods stock market investors put to use to evaluate their holdings. Two of the most underrated methods are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can beat their index-focused peers by a solid amount (see the details here).

We’re going to review the new hedge fund action surrounding Stifel Financial Corp. (NYSE:SF).

What have hedge funds been doing with Stifel Financial Corp. (NYSE:SF)?

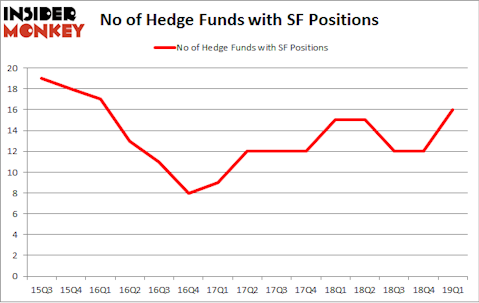

Heading into the second quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards SF over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the most valuable position in Stifel Financial Corp. (NYSE:SF), worth close to $82 million, accounting for 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Millennium Management, managed by Israel Englander, which holds a $26.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors with similar optimism encompass Robert Pohly’s Samlyn Capital, Ravi Chopra’s Azora Capital and James Parsons’s Junto Capital Management.

Now, key money managers have jumped into Stifel Financial Corp. (NYSE:SF) headfirst. Samlyn Capital, managed by Robert Pohly, assembled the most outsized position in Stifel Financial Corp. (NYSE:SF). Samlyn Capital had $23.3 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also initiated a $13.4 million position during the quarter. The other funds with brand new SF positions are Gregg Moskowitz’s Interval Partners, Matthew Tewksbury’s Stevens Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now take a look at hedge fund activity in other stocks similar to Stifel Financial Corp. (NYSE:SF). We will take a look at Tech Data Corp (NASDAQ:TECD), Weingarten Realty Investors (NYSE:WRI), BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), and Vermilion Energy Inc (NYSE:VET). This group of stocks’ market caps match SF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TECD | 19 | 307621 | -4 |

| WRI | 13 | 58932 | 1 |

| BJ | 22 | 256004 | 6 |

| VET | 6 | 18169 | -1 |

| Average | 15 | 160182 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $172 million in SF’s case. BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) is the most popular stock in this table. On the other hand Vermilion Energy Inc (NYSE:VET) is the least popular one with only 6 bullish hedge fund positions. Stifel Financial Corp. (NYSE:SF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on SF as the stock returned 6.4% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.