What do Slack Technologies, Tesla Inc, and Lyft Inc have in common? We are going to answer this question at the end of this article. Insider Monkey has processed 740 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Slack Technologies Inc (NYSE:WORK) based on that data.

Slack Technologies Inc (NYSE:WORK) was in 37 hedge funds’ portfolios at the end of June. The total value of hedge fund holdings in the company was $818 million, corresponding to about 4.4% of Slack’s outstanding shares. Before getting into the meaning of these numbers, let us explain why we care about hedge fund sentiment in WORK.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned more than 30% not counting today’s gains and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception 5 years ago (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s review the recent hedge fund action regarding Slack Technologies Inc (NYSE:WORK).

Hedge fund activity in Slack Technologies Inc (NYSE:WORK)

At the end of the second quarter, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 37 from one quarter earlier (the stock IPO’ed in Q2). Glen Kacher’s Light Street Capital is by far the most bullish fund manager regarding Slack Technologies. Kacher’s technology focused hedge fund had nearly $200 million invested in the stock and allocated nearly 11% of its 13F portfolio to WORK.

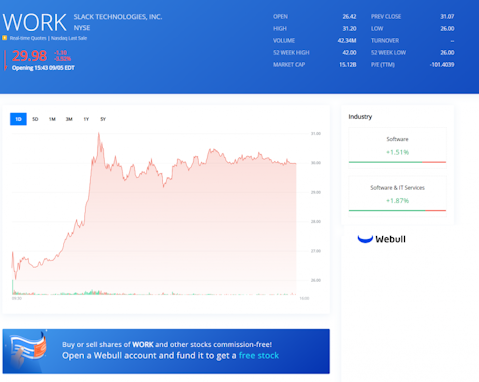

On the heels of Light Street was another Tiger cub, Andreas Halvorsen. Viking Global had $170 million invested in Slack at the end of Q2 but this was only 0.8% of its 13F portfolio. As you can see from the above chart provided by Webull, Slack Technologies shares lost nearly 3.5% today after disappointing earnings (though the losses were much larger earlier in the day).

Overall hedge fund sentiment towards Slack is average. There were 23 other stocks with exactly 37 bullish hedge fund positions in our list and nine of these stocks had smaller market caps than Slack. Some of these companies are Tesla Inc (NASDAQ:TSLA), Lyft Inc (NASDAQ:LYFT), and another IPO Tradeweb Markets (NASDAQ:TW). Slack’s overall popularity ranking was 288. Compared to S&P 500 constituents, Slack’s hedge fund ranking score is somewhere in the middle.

Based on this data, we wouldn’t recommend any long or short positions in Slack. At Insider Monkey we care about the extremes. Slack shares lost 20% since the end of Q2 whereas the 30 most popular stocks among hedge funds outperformed the S&P 500 Index by 1.3 percentage points through Friday. By tracking hedge funds we just identified a stock that’s growing as fast as Slack, yet profitable and trading at a very attractive multiple. We don’t think Slack is the right stock for our readers at this moment.

Disclosure: None. This article was originally published at Insider Monkey.