How do we determine whether Nielsen Holdings plc (NYSE:NLSN) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

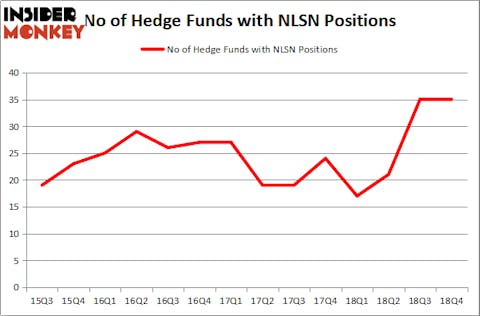

Nielsen Holdings plc (NYSE:NLSN) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 35 hedge funds’ portfolios at the end of the fourth quarter of 2018. At the end of this article we will also compare NLSN to other stocks including DENTSPLY SIRONA Inc. (NASDAQ:XRAY), Tata Motors Limited (NYSE:TTM), and Trimble Inc. (NASDAQ:TRMB) to get a better sense of its popularity.

If you’d ask most market participants, hedge funds are viewed as underperforming, outdated financial vehicles of the past. While there are more than 8000 funds with their doors open at present, Our experts hone in on the aristocrats of this group, approximately 750 funds. Most estimates calculate that this group of people handle bulk of the hedge fund industry’s total asset base, and by tailing their best picks, Insider Monkey has unsheathed several investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a gander at the new hedge fund action regarding Nielsen Holdings plc (NYSE:NLSN).

How have hedgies been trading Nielsen Holdings plc (NYSE:NLSN)?

At Q4’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in NLSN a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Nielsen Holdings plc (NYSE:NLSN) was held by Windacre Partnership, which reported holding $351.5 million worth of stock at the end of September. It was followed by Elliott Management with a $326.6 million position. Other investors bullish on the company included Ariel Investments, Deccan Value Advisors, and Citadel Investment Group.

Due to the fact that Nielsen Holdings plc (NYSE:NLSN) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedgies that slashed their positions entirely heading into Q3. At the top of the heap, James Dinan’s York Capital Management said goodbye to the biggest stake of the 700 funds followed by Insider Monkey, worth close to $34.2 million in stock, and Derek C. Schrier’s Indaba Capital Management was right behind this move, as the fund cut about $20.6 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Nielsen Holdings plc (NYSE:NLSN) but similarly valued. We will take a look at DENTSPLY SIRONA Inc. (NASDAQ:XRAY), Tata Motors Limited (NYSE:TTM), Trimble Inc. (NASDAQ:TRMB), and Targa Resources Corp (NYSE:TRGP). This group of stocks’ market values are similar to NLSN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XRAY | 27 | 1420722 | -1 |

| TTM | 9 | 108095 | 0 |

| TRMB | 17 | 493848 | 0 |

| TRGP | 35 | 485408 | 14 |

| Average | 22 | 627018 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $627 million. That figure was $1289 million in NLSN’s case. Targa Resources Corp (NYSE:TRGP) is the most popular stock in this table. On the other hand Tata Motors Limited (NYSE:TTM) is the least popular one with only 9 bullish hedge fund positions. Nielsen Holdings plc (NYSE:NLSN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately NLSN wasn’t in this group. Hedge funds that bet on NLSN were disappointed as the stock returned 13% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.