Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the nearly unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Nicolet Bankshares Inc. (NASDAQ:NCBS) investors should pay attention to an increase in enthusiasm from smart money of late. Our calculations also showed that NCBS isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are tons of metrics market participants have at their disposal to value stocks. Two of the most underrated metrics are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the elite investment managers can trounce the S&P 500 by a very impressive margin (see the details here).

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s take a look at the new hedge fund action encompassing Nicolet Bankshares Inc. (NASDAQ:NCBS).

Hedge fund activity in Nicolet Bankshares Inc. (NASDAQ:NCBS)

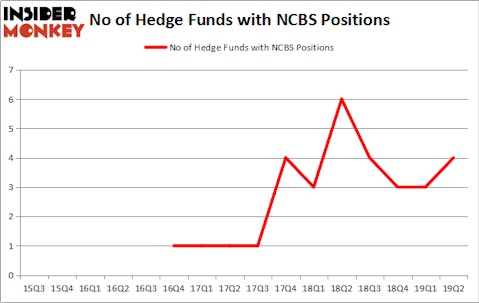

At the end of the second quarter, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the first quarter of 2019. On the other hand, there were a total of 6 hedge funds with a bullish position in NCBS a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies has the number one position in Nicolet Bankshares Inc. (NASDAQ:NCBS), worth close to $5.2 million, accounting for less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $0.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism include Michael Gelband’s ExodusPoint Capital, and John Overdeck and David Siegel’s Two Sigma Advisors.

Consequently, specific money managers were breaking ground themselves. ExodusPoint Capital, managed by Michael Gelband, established the largest position in Nicolet Bankshares Inc. (NASDAQ:NCBS). ExodusPoint Capital had $0.2 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $0.2 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to Nicolet Bankshares Inc. (NASDAQ:NCBS). These stocks are TPG Pace Holdings Corp. (NYSE:TPGH), ChipMOS TECHNOLOGIES INC. (NASDAQ:IMOS), America’s Car-Mart, Inc. (NASDAQ:CRMT), and Textainer Group Holdings Limited (NYSE:TGH). All of these stocks’ market caps are closest to NCBS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPGH | 19 | 239546 | 1 |

| IMOS | 2 | 23209 | 0 |

| CRMT | 23 | 84560 | 3 |

| TGH | 7 | 17426 | -3 |

| Average | 12.75 | 91185 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $6 million in NCBS’s case. America’s Car-Mart, Inc. (NASDAQ:CRMT) is the most popular stock in this table. On the other hand ChipMOS TECHNOLOGIES INC. (NASDAQ:IMOS) is the least popular one with only 2 bullish hedge fund positions. Nicolet Bankshares Inc. (NASDAQ:NCBS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on NCBS as the stock returned 7.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.