Is Lockheed Martin Corporation (NYSE:LMT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

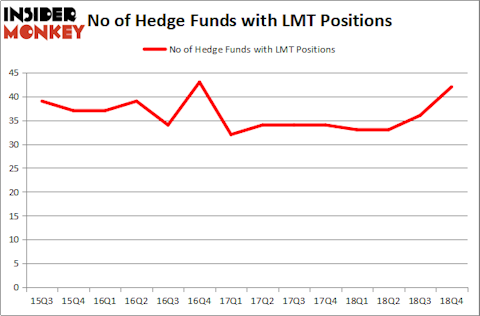

Lockheed Martin Corporation (NYSE:LMT) shareholders have witnessed an increase in hedge fund interest lately. Our calculations also showed that LMT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action regarding Lockheed Martin Corporation (NYSE:LMT).

How are hedge funds trading Lockheed Martin Corporation (NYSE:LMT)?

At the end of the fourth quarter, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the second quarter of 2018. On the other hand, there were a total of 33 hedge funds with a bullish position in LMT a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Lockheed Martin Corporation (NYSE:LMT) was held by Two Sigma Advisors, which reported holding $268.5 million worth of stock at the end of September. It was followed by AQR Capital Management with a $219 million position. Other investors bullish on the company included D E Shaw, Adage Capital Management, and Renaissance Technologies.

Consequently, key hedge funds were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, assembled the biggest position in Lockheed Martin Corporation (NYSE:LMT). Renaissance Technologies had $73.2 million invested in the company at the end of the quarter. Matt Simon (Citadel)’s Ashler Capital also initiated a $52.8 million position during the quarter. The other funds with new positions in the stock are Frank Brosens’s Taconic Capital, Matthew Tewksbury’s Stevens Capital Management, and Sander Gerber’s Hudson Bay Capital Management.

Let’s go over hedge fund activity in other stocks similar to Lockheed Martin Corporation (NYSE:LMT). We will take a look at Lowe’s Companies, Inc. (NYSE:LOW), U.S. Bancorp (NYSE:USB), British American Tobacco plc (NYSEAMEX:BTI), and Banco Santander, S.A. (NYSE:SAN). This group of stocks’ market valuations are closest to LMT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LOW | 53 | 4173120 | -4 |

| USB | 41 | 6538818 | 2 |

| BTI | 10 | 191500 | -5 |

| SAN | 18 | 698131 | -1 |

| Average | 30.5 | 2900392 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $2900 million. That figure was $1269 million in LMT’s case. Lowe’s Companies, Inc. (NYSE:LOW) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSEAMEX:BTI) is the least popular one with only 10 bullish hedge fund positions. Lockheed Martin Corporation (NYSE:LMT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on LMT, though not to the same extent, as the stock returned 13.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.