The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Life Storage, Inc. (NYSE:LSI).

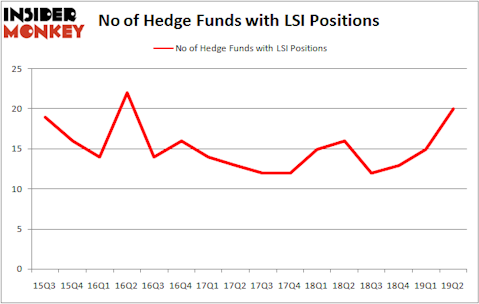

Life Storage, Inc. (NYSE:LSI) shareholders have witnessed an increase in hedge fund sentiment lately. LSI was in 20 hedge funds’ portfolios at the end of June. There were 15 hedge funds in our database with LSI holdings at the end of the previous quarter. Our calculations also showed that LSI isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are perceived as underperforming, old financial tools of years past. While there are more than 8000 funds in operation at present, We hone in on the elite of this club, around 750 funds. These investment experts handle bulk of all hedge funds’ total capital, and by tailing their top stock picks, Insider Monkey has found a few investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the fresh hedge fund action encompassing Life Storage, Inc. (NYSE:LSI).

What does smart money think about Life Storage, Inc. (NYSE:LSI)?

At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the first quarter of 2019. On the other hand, there were a total of 16 hedge funds with a bullish position in LSI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies, holds the number one position in Life Storage, Inc. (NYSE:LSI). Renaissance Technologies has a $57.2 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Long Pond Capital, managed by John Khoury, which holds a $53.7 million position; 1.6% of its 13F portfolio is allocated to the stock. Other peers with similar optimism comprise Israel Englander’s Millennium Management, Greg Poole’s Echo Street Capital Management and Dmitry Balyasny’s Balyasny Asset Management.

As aggregate interest increased, specific money managers have been driving this bullishness. Long Pond Capital, managed by John Khoury, established the biggest position in Life Storage, Inc. (NYSE:LSI). Long Pond Capital had $53.7 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $0.9 million position during the quarter. The following funds were also among the new LSI investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Alec Litowitz and Ross Laser’s Magnetar Capital, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks similar to Life Storage, Inc. (NYSE:LSI). We will take a look at PacWest Bancorp (NASDAQ:PACW), Selective Insurance Group, Inc. (NASDAQ:SIGI), Manhattan Associates, Inc. (NASDAQ:MANH), and Silicon Laboratories Inc. (NASDAQ:SLAB). This group of stocks’ market values are closest to LSI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PACW | 20 | 223740 | -1 |

| SIGI | 14 | 43688 | 2 |

| MANH | 17 | 425498 | -1 |

| SLAB | 18 | 73662 | 6 |

| Average | 17.25 | 191647 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $192 million. That figure was $349 million in LSI’s case. PacWest Bancorp (NASDAQ:PACW) is the most popular stock in this table. On the other hand Selective Insurance Group, Inc. (NASDAQ:SIGI) is the least popular one with only 14 bullish hedge fund positions. Life Storage, Inc. (NYSE:LSI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on LSI as the stock returned 12% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.