We can judge whether KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

Hedge fund interest in KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare KALV to other stocks including Viveve Medical, Inc. (NASDAQ:VIVE), Stealth BioTherapeutics Corp (NASDAQ:MITO), and Palatin Technologies, Inc. (NYSEAMEX:PTN) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are many indicators stock traders employ to grade publicly traded companies. A duo of the best indicators are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top fund managers can trounce their index-focused peers by a superb amount (see the details here).

James E. Flynn of Deerfield Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to go over the latest hedge fund action regarding KalVista Pharmaceuticals, Inc. (NASDAQ:KALV).

How are hedge funds trading KalVista Pharmaceuticals, Inc. (NASDAQ:KALV)?

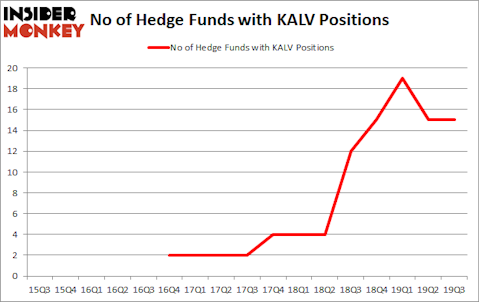

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in KALV a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Vivo Capital held the most valuable stake in KalVista Pharmaceuticals, Inc. (NASDAQ:KALV), which was worth $17.1 million at the end of the third quarter. On the second spot was Polar Capital which amassed $16.3 million worth of shares. Deerfield Management, Adage Capital Management, and Ghost Tree Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Vivo Capital allocated the biggest weight to KalVista Pharmaceuticals, Inc. (NASDAQ:KALV), around 1.95% of its 13F portfolio. Samsara BioCapital is also relatively very bullish on the stock, dishing out 0.94 percent of its 13F equity portfolio to KALV.

Because KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) has faced bearish sentiment from hedge fund managers, it’s safe to say that there were a few hedge funds that slashed their entire stakes by the end of the third quarter. It’s worth mentioning that Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management said goodbye to the biggest investment of all the hedgies monitored by Insider Monkey, valued at about $0.4 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also said goodbye to its stock, about $0.2 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) but similarly valued. These stocks are Viveve Medical, Inc. (NASDAQ:VIVE), Stealth BioTherapeutics Corp (NASDAQ:MITO), Palatin Technologies, Inc. (NYSEAMEX:PTN), and American Renal Associates Holdings, Inc (NYSE:ARA). All of these stocks’ market caps are similar to KALV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VIVE | 1 | 3 | -2 |

| MITO | 2 | 2539 | 0 |

| PTN | 6 | 2225 | 1 |

| ARA | 6 | 118306 | 1 |

| Average | 3.75 | 30768 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $31 million. That figure was $60 million in KALV’s case. Palatin Technologies, Inc. (NYSEAMEX:PTN) is the most popular stock in this table. On the other hand Viveve Medical, Inc. (NASDAQ:VIVE) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks KalVista Pharmaceuticals, Inc. (NASDAQ:KALV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on KALV as the stock returned 24.8% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.