Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in October due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 30 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 6.7% through November 15th whereas the S&P 500 Index ETF gained only 2.6% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Graco Inc. (NYSE:GGG) from the perspective of those elite funds.

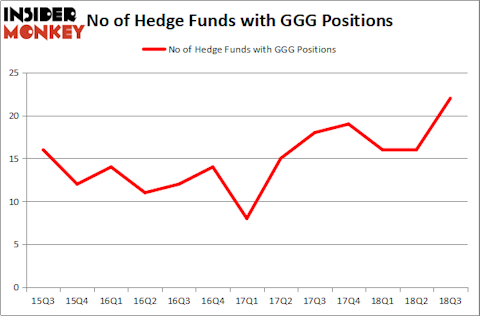

Is Graco Inc. (NYSE:GGG) the right pick for your portfolio? Investors who are in the know are becoming hopeful. The number of long hedge fund positions moved up by 6 recently. Our calculations also showed that GGG isn’t among the 30 most popular stocks among hedge funds. GGG was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. There were 16 hedge funds in our database with GGG holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the recent hedge fund action surrounding Graco Inc. (NYSE:GGG).

What does the smart money think about Graco Inc. (NYSE:GGG)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GGG over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Graco Inc. (NYSE:GGG) was held by GAMCO Investors, which reported holding $120.5 million worth of stock at the end of September. It was followed by Royce & Associates with a $26.1 million position. Other investors bullish on the company included Millennium Management, GLG Partners, and Two Sigma Advisors.

As aggregate interest increased, key money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most outsized position in Graco Inc. (NYSE:GGG). Marshall Wace LLP had $7.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $3.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Matthew Tewksbury’s Stevens Capital Management, Brandon Haley’s Holocene Advisors, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Graco Inc. (NYSE:GGG) but similarly valued. We will take a look at Roku, Inc. (NASDAQ:ROKU), Israel Chemicals Ltd. (NYSE:ICL), Pinnacle Foods Inc (NYSE:PF), and Bio-Techne Corporation (NASDAQ:TECH). This group of stocks’ market valuations are closest to GGG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROKU | 31 | 788092 | 8 |

| ICL | 8 | 40795 | 2 |

| PF | 35 | 2333165 | -11 |

| TECH | 18 | 316289 | 1 |

| Average | 23 | 869585 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $870 million. That figure was $219 million in GGG’s case. Pinnacle Foods Inc (NYSE:PF) is the most popular stock in this table. On the other hand Israel Chemicals Ltd. (NYSE:ICL) is the least popular one with only 8 bullish hedge fund positions. Graco Inc. (NYSE:GGG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.