Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Flowserve Corporation (NYSE:FLS).

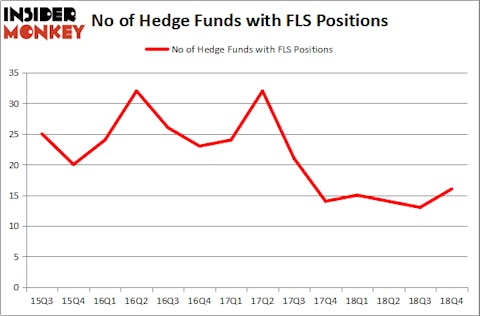

Is Flowserve Corporation (NYSE:FLS) going to take off soon? Investors who are in the know are becoming more confident. The number of long hedge fund positions advanced by 3 recently. Our calculations also showed that FLS isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action regarding Flowserve Corporation (NYSE:FLS).

What does the smart money think about Flowserve Corporation (NYSE:FLS)?

Heading into the first quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 23% from the previous quarter. On the other hand, there were a total of 15 hedge funds with a bullish position in FLS a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, GAMCO Investors was the largest shareholder of Flowserve Corporation (NYSE:FLS), with a stake worth $99.8 million reported as of the end of September. Trailing GAMCO Investors was Impax Asset Management, which amassed a stake valued at $35.6 million. Millennium Management, Gotham Asset Management, and Element Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers have jumped into Flowserve Corporation (NYSE:FLS) headfirst. Gotham Asset Management, managed by Joel Greenblatt, initiated the most valuable position in Flowserve Corporation (NYSE:FLS). Gotham Asset Management had $5.8 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $5.7 million position during the quarter. The following funds were also among the new FLS investors: Matthew Tewksbury’s Stevens Capital Management, Ray Dalio’s Bridgewater Associates, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now review hedge fund activity in other stocks similar to Flowserve Corporation (NYSE:FLS). These stocks are Galapagos NV (NASDAQ:GLPG), Alcoa Corporation (NYSE:AA), Aurora Cannabis Inc. (NYSE:ACB), and Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC). All of these stocks’ market caps are closest to FLS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLPG | 15 | 92765 | -1 |

| AA | 30 | 402782 | -8 |

| ACB | 9 | 42637 | 9 |

| TKC | 9 | 15197 | 1 |

| Average | 15.75 | 138345 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $138 million. That figure was $179 million in FLS’s case. Alcoa Corporation (NYSE:AA) is the most popular stock in this table. On the other hand Aurora Cannabis Inc. (NYSE:ACB) is the least popular one with only 9 bullish hedge fund positions. Flowserve Corporation (NYSE:FLS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on FLS as the stock returned 32.4% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.