Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

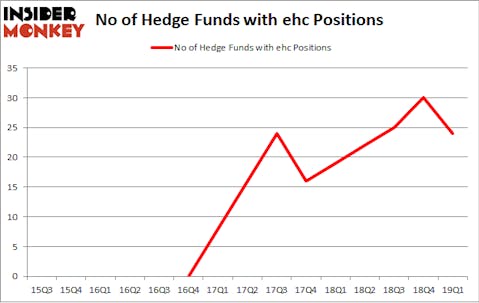

Encompass Health Corporation (NYSE:EHC) shareholders have witnessed a decrease in hedge fund sentiment of late. Our calculations also showed that ehc isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action regarding Encompass Health Corporation (NYSE:EHC).

Hedge fund activity in Encompass Health Corporation (NYSE:EHC)

At Q1’s end, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from the previous quarter. By comparison, 19 hedge funds held shares or bullish call options in EHC a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Encompass Health Corporation (NYSE:EHC), which was worth $130.7 million at the end of the first quarter. On the second spot was D E Shaw which amassed $53 million worth of shares. Moreover, Rock Springs Capital Management, Two Sigma Advisors, and Millennium Management were also bullish on Encompass Health Corporation (NYSE:EHC), allocating a large percentage of their portfolios to this stock.

Seeing as Encompass Health Corporation (NYSE:EHC) has experienced declining sentiment from hedge fund managers, it’s easy to see that there exists a select few fund managers who sold off their entire stakes by the end of the third quarter. It’s worth mentioning that Vishal Saluja and Pham Quang’s Endurant Capital Management cut the biggest stake of the 700 funds tracked by Insider Monkey, worth close to $5.3 million in stock, and Anand Parekh’s Alyeska Investment Group was right behind this move, as the fund dumped about $1.9 million worth. These moves are interesting, as total hedge fund interest was cut by 6 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Encompass Health Corporation (NYSE:EHC) but similarly valued. We will take a look at EPR Properties (NYSE:EPR), First American Financial Corp (NYSE:FAF), HUYA Inc. (NYSE:HUYA), and Brookfield Renewable Partners L.P. (NYSE:BEP). This group of stocks’ market values resemble EHC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPR | 17 | 136803 | -5 |

| FAF | 30 | 679005 | -3 |

| HUYA | 21 | 307858 | 5 |

| BEP | 3 | 2816 | 0 |

| Average | 17.75 | 281621 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $465 million in EHC’s case. First American Financial Corp (NYSE:FAF) is the most popular stock in this table. On the other hand Brookfield Renewable Partners L.P. (NYSE:BEP) is the least popular one with only 3 bullish hedge fund positions. Encompass Health Corporation (NYSE:EHC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on EHC, though not to the same extent, as the stock returned 1.6% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.