It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Diamond Hill Investment Group, Inc. (NASDAQ:DHIL).

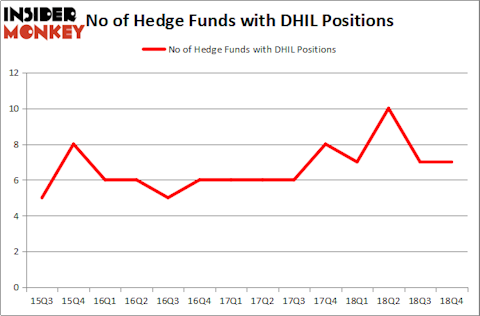

Hedge fund interest in Diamond Hill Investment Group, Inc. (NASDAQ:DHIL) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Sunlands Online Education Group (NYSE:STG), Kimball International Inc (NASDAQ:KBAL), and KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) to gather more data points.

In the eyes of most shareholders, hedge funds are seen as unimportant, old investment vehicles of the past. While there are over 8000 funds in operation at present, Our researchers hone in on the top tier of this group, approximately 750 funds. It is estimated that this group of investors direct most of the smart money’s total capital, and by paying attention to their matchless picks, Insider Monkey has figured out several investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s check out the fresh hedge fund action regarding Diamond Hill Investment Group, Inc. (NASDAQ:DHIL).

How are hedge funds trading Diamond Hill Investment Group, Inc. (NASDAQ:DHIL)?

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in DHIL a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Diamond Hill Investment Group, Inc. (NASDAQ:DHIL) was held by Renaissance Technologies, which reported holding $16.2 million worth of stock at the end of December. It was followed by Akre Capital Management with a $9.8 million position. Other investors bullish on the company included Royce & Associates, AQR Capital Management, and Highland Capital Management.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Zebra Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Highland Capital Management).

Let’s now take a look at hedge fund activity in other stocks similar to Diamond Hill Investment Group, Inc. (NASDAQ:DHIL). We will take a look at Sunlands Technology Group (NYSE:STG), Kimball International Inc (NASDAQ:KBAL), KLX Energy Services Holdings, Inc. (NASDAQ:KLXE), and Navigator Holdings Ltd (NYSE:NVGS). This group of stocks’ market values are similar to DHIL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STG | 2 | 959 | -3 |

| KBAL | 10 | 89826 | -2 |

| KLXE | 9 | 41774 | -12 |

| NVGS | 12 | 235591 | 4 |

| Average | 8.25 | 92038 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $40 million in DHIL’s case. Navigator Holdings Ltd (NYSE:NVGS) is the most popular stock in this table. On the other hand Sunlands Technology Group (NYSE:STG) is the least popular one with only 2 bullish hedge fund positions. Diamond Hill Investment Group, Inc. (NASDAQ:DHIL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately DHIL wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); DHIL investors were disappointed as the stock returned -4.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.