You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

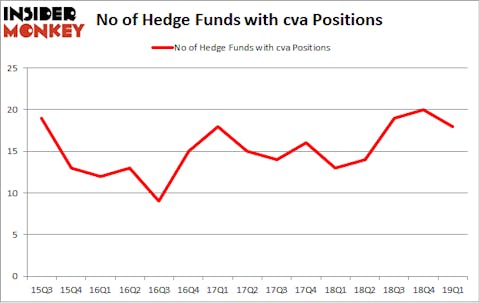

Covanta Holding Corporation (NYSE:CVA) was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. CVA has experienced a decrease in hedge fund interest of late. There were 20 hedge funds in our database with CVA holdings at the end of the previous quarter. Our calculations also showed that cva isn’t among the 30 most popular stocks among hedge funds.

Today there are numerous signals stock traders have at their disposal to assess their stock investments. Some of the most useful signals are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can beat the market by a healthy amount (see the details here).

Let’s go over the new hedge fund action encompassing Covanta Holding Corporation (NYSE:CVA).

What have hedge funds been doing with Covanta Holding Corporation (NYSE:CVA)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in CVA a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in Covanta Holding Corporation (NYSE:CVA) was held by Levin Capital Strategies, which reported holding $41.1 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $17.8 million position. Other investors bullish on the company included Ecofin Ltd, Citadel Investment Group, and GAMCO Investors.

Due to the fact that Covanta Holding Corporation (NYSE:CVA) has witnessed falling interest from the smart money, it’s easy to see that there were a few money managers who were dropping their full holdings by the end of the third quarter. Interestingly, Matthew Hulsizer’s PEAK6 Capital Management sold off the largest position of the 700 funds watched by Insider Monkey, worth an estimated $1 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund cut about $0.2 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Covanta Holding Corporation (NYSE:CVA). We will take a look at Simmons First National Corporation (NASDAQ:SFNC), Terex Corporation (NYSE:TEX), ProPetro Holding Corp. (NYSE:PUMP), and Insmed Incorporated (NASDAQ:INSM). This group of stocks’ market caps match CVA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SFNC | 9 | 16011 | 2 |

| TEX | 21 | 353360 | 8 |

| PUMP | 21 | 259649 | 1 |

| INSM | 18 | 456768 | 2 |

| Average | 17.25 | 271447 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $271 million. That figure was $92 million in CVA’s case. Terex Corporation (NYSE:TEX) is the most popular stock in this table. On the other hand Simmons First National Corporation (NASDAQ:SFNC) is the least popular one with only 9 bullish hedge fund positions. Covanta Holding Corporation (NYSE:CVA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CVA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CVA were disappointed as the stock returned -3.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.