Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Covanta Holding Corporation (NYSE:CVA), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

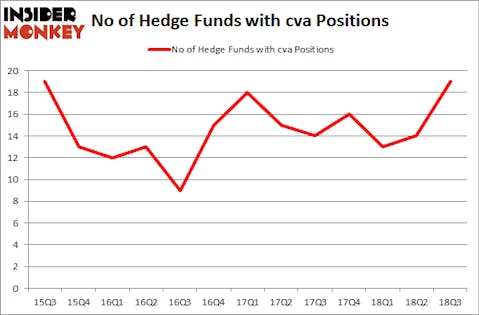

Is Covanta Holding Corporation (NYSE:CVA) a buy here? Hedge funds are getting more bullish. The number of long hedge fund bets advanced by 5 in recent months. Our calculations also showed that cva isn’t among the 30 most popular stocks among hedge funds. CVA was in 19 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with CVA positions at the end of the previous quarter.

At the moment there are several methods stock traders have at their disposal to grade their holdings. Some of the most innovative methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outpace the S&P 500 by a very impressive amount (see the details here).

Let’s take a look at the fresh hedge fund action regarding Covanta Holding Corporation (NYSE:CVA).

How are hedge funds trading Covanta Holding Corporation (NYSE:CVA)?

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in CVA heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Levin Capital Strategies held the most valuable stake in Covanta Holding Corporation (NYSE:CVA), which was worth $38.5 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $20.4 million worth of shares. Moreover, GMT Capital, Ecofin Ltd, and GAMCO Investors were also bullish on Covanta Holding Corporation (NYSE:CVA), allocating a large percentage of their portfolios to this stock.

Now, some big names have been driving this bullishness. Millennium Management, managed by Israel Englander, created the biggest position in Covanta Holding Corporation (NYSE:CVA). Millennium Management had $1.4 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also made a $0.9 million investment in the stock during the quarter. The other funds with brand new CVA positions are Jeffrey Talpins’s Element Capital Management and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s go over hedge fund activity in other stocks similar to Covanta Holding Corporation (NYSE:CVA). These stocks are Medpace Holdings, Inc. (NASDAQ:MEDP), Travelport Worldwide Ltd (NYSE:TVPT), ABM Industries, Inc. (NYSE:ABM), and BioTelemetry, Inc. (NASDAQ:BEAT). This group of stocks’ market valuations resemble CVA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MEDP | 26 | 286235 | 8 |

| TVPT | 23 | 253987 | 1 |

| ABM | 11 | 61035 | -3 |

| BEAT | 16 | 67760 | 1 |

| Average | 19 | 167254 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $167 million. That figure was $105 million in CVA’s case. Medpace Holdings, Inc. (NASDAQ:MEDP) is the most popular stock in this table. On the other hand ABM Industries, Inc. (NYSE:ABM) is the least popular one with only 11 bullish hedge fund positions. Covanta Holding Corporation (NYSE:CVA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MEDP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.