Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Constellium NV (NYSE:CSTM)? The smart money sentiment can provide an answer to this question.

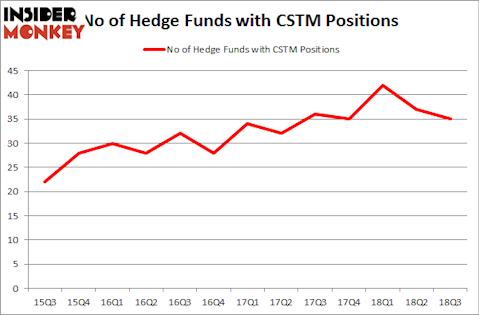

Is Constellium NV (NYSE:CSTM) the right investment to pursue these days? Prominent investors are reducing their bets on the stock. The number of long hedge fund bets went down by 2 lately. Our calculations also showed that CSTM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the recent hedge fund action encompassing Constellium NV (NYSE:CSTM).

How are hedge funds trading Constellium NV (NYSE:CSTM)?

Heading into the fourth quarter of 2018, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from one quarter earlier. On the other hand, there were a total of 35 hedge funds with a bullish position in CSTM at the beginning of this year. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Peter S. Park’s Park West Asset Management has the number one position in Constellium NV (NYSE:CSTM), worth close to $40.3 million, corresponding to 1.5% of its total 13F portfolio. Coming in second is James Dinan of York Capital Management, with a $30.6 million position; 1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish comprise Mark Kingdon’s Kingdon Capital, David Rosen’s Rubric Capital Management and Larry Foley and Paul Farrell’s Bronson Point Partners.

Seeing as Constellium NV (NYSE:CSTM) has faced declining sentiment from the smart money, it’s safe to say that there is a sect of fund managers who were dropping their positions entirely in the third quarter. Intriguingly, Phill Gross and Robert Atchinson’s Adage Capital Management sold off the largest investment of all the hedgies followed by Insider Monkey, totaling an estimated $8.2 million in stock. Bart Baum’s fund, Ionic Capital Management, also dropped its stock, about $4.9 million worth. These moves are interesting, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Constellium NV (NYSE:CSTM). We will take a look at Enanta Pharmaceuticals Inc (NASDAQ:ENTA), Gentherm Inc (NASDAQ:THRM), HFF, Inc. (NYSE:HF), and Park National Corporation (NYSEAMEX:PRK). This group of stocks’ market caps are similar to CSTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENTA | 21 | 246143 | 3 |

| THRM | 13 | 104110 | -1 |

| HF | 10 | 14058 | -1 |

| PRK | 12 | 20544 | 5 |

| Average | 14 | 96214 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $440 million in CSTM’s case. Enanta Pharmaceuticals Inc (NASDAQ:ENTA) is the most popular stock in this table. On the other hand HFF, Inc. (NYSE:HF) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Constellium NV (NYSE:CSTM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.